Daily Market Outlook, March 1, 2024

Munnelly’s Market Minute…

“The Nikkei Opens The New Month With A Surge To Record Highs”

The new month starts with Japan's Nikkei Average hitting a new high above the 40K handle, following the S&P 500 and Nasdaq closing at record highs on Thursday, driven by tech stocks related to AI. Nvidia, a major chipmaker, contributed significantly to the benchmark indexes, while Advanced Micro Devices, a smaller rival, also saw a surge. Most Asian equity markets are higher. China's composite PMI for February remained unchanged at 50.9, indicating weaker manufacturing but stronger growth in other areas. Bank of Japan Governor Ueda suggested that it would take time to determine if the price target had been met, hinting that an immediate interest rate hike is unlikely.

The Eurozone's February CPI inflation data is forecast to show a decline in annual headline inflation to 2.6% from 2.8% in January, primarily due to a decrease in core inflation to a 2-year low of 2.9% from 3.3%.Despite remaining above the 2.0% target, inflation is expected to fall further over the coming months, potentially leading to speculation about a rate cut by the European Central Bank in April.The Eurozone unemployment rate is expected to remain at a cyclical low of 6.4% in January, maintaining concerns about wage growth. The February Eurozone PMI manufacturing data is not expected to be revised significantly, remaining below the 50 expansionary level. In the UK, Bank of England Chief Economist Huw Pill is scheduled to speak.

Stateside,the US Congress passed a stop-gap measure to avoid a partial government shutdown, providing another week to agree on a comprehensive bill.The ISM manufacturing index for February is anticipated to show strength, with expectations of reaching 50 for the first time since late 2022. The University of Michigan sentiment data is expected to validate the headline sentiment of 79.6. Additionally, there will be a focus on the inflation indicators, as the preliminary data indicated that the 1-year outlook remained steady at 2.9%, while the 5-10 year outlook declined by 0.1 percentage points to 2.8%.There are numerous scheduled speeches from US Federal Reserve officials, with markets eagerly anticipating Fed Chair Powell's update next week.

Overnight Newswire Updates of Note

Congress Delays Government Shutdown For Another Week

Fed's Mester Still Expects Three Rate Cuts In 2024 After New Inflation Reading

Fed’s Daly: Officials ‘Ready’ To Cut Interest Rates When Data Demands It

Fed's Goolsbee: Jan Inflation Rebound Shouldn’t Overshadow Last Year's Progress

ECB’s Panetta Says Inflation Is Falling Faster Than Expected

UK Chancellor Leans Toward Retaining 5 Pence-Per-Litre UK Fuel Duty Cut

BoJ Chief Ueda Stops Short Of Declaring 2% Price Goal Met

RBNZ’s Orr: Inflation Is Still Too High But Is Falling

World Economy Has Growing Chance Of Soft Landing, G-20 Says

Japan’s Tight Labour Market To Keep Upward Pressure On Wages

South Korean Exports Rise For 5th Straight Month In February

Bank Of America, Wells Fargo To Offer Spot Bitcoin ETFs To Clients

Hewlett Packard Enterprise Q1 Revenue Drops On Server, Hybrid Cloud Hit

Dell Jumps On Server Sales Fuelled By Excitement For AI Work

Disney Family Rebukes Nelson Peltz, Praises Bob Iger In Shareholder Letters

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0865 (EU1.6b), 1.0800 (EU1.31b), 1.0850 (EU759m)

USD/JPY: 148.30 ($954.5m), 150.35 ($903.2m), 149.00 ($831m)

AUD/USD: 0.5855 (AUD780m), 0.6400 (AUD352.7m), 0.6370 (AUD300m)

USD/CAD: 1.3195 ($1.03b), 1.3310 ($706.8m), 1.3410 ($532m)

USD/CNY: 7.2500 ($758.4m), 7.4400 ($719.4m), 7.1000 ($302m)

GBP/USD: 1.1150 (GBP500m), 1.2500 (GBP406.8m)

CFTC Data As Of 20/02/24

Japanese Yen net short position is -120,778 contracts.

British Pound net long position is 46,312 contracts.

Euro net long position is 68,016 contracts

bitcoin net short position is -2,098 contracts.

Swiss Franc posts net short position of -9,923 contracts.

Equity Fund managers raise S&P 500 CME net long position by 17.027 contracts to 947,280.

Equity fund speculators increase S&P 500 CME net short position by 35.358 contracts to 419,832.

Technical & Trade Views

SP500 Bullish Above Bearish Below 5080

Daily VWAP bearish

Weekly VWAP bullish

Below 5030 opens 5000

Primary support 4940

Primary objective is 5120

Munnelly’s Market Minute…

“The Nikkei Opens The New Month With A Surge To Record Highs”

The new month starts with Japan's Nikkei Average hitting a new high above the 40K handle, following the S&P 500 and Nasdaq closing at record highs on Thursday, driven by tech stocks related to AI. Nvidia, a major chipmaker, contributed significantly to the benchmark indexes, while Advanced Micro Devices, a smaller rival, also saw a surge. Most Asian equity markets are higher. China's composite PMI for February remained unchanged at 50.9, indicating weaker manufacturing but stronger growth in other areas. Bank of Japan Governor Ueda suggested that it would take time to determine if the price target had been met, hinting that an immediate interest rate hike is unlikely.

The Eurozone's February CPI inflation data is forecast to show a decline in annual headline inflation to 2.6% from 2.8% in January, primarily due to a decrease in core inflation to a 2-year low of 2.9% from 3.3%.Despite remaining above the 2.0% target, inflation is expected to fall further over the coming months, potentially leading to speculation about a rate cut by the European Central Bank in April.The Eurozone unemployment rate is expected to remain at a cyclical low of 6.4% in January, maintaining concerns about wage growth. The February Eurozone PMI manufacturing data is not expected to be revised significantly, remaining below the 50 expansionary level. In the UK, Bank of England Chief Economist Huw Pill is scheduled to speak.

Stateside,the US Congress passed a stop-gap measure to avoid a partial government shutdown, providing another week to agree on a comprehensive bill.The ISM manufacturing index for February is anticipated to show strength, with expectations of reaching 50 for the first time since late 2022. The University of Michigan sentiment data is expected to validate the headline sentiment of 79.6. Additionally, there will be a focus on the inflation indicators, as the preliminary data indicated that the 1-year outlook remained steady at 2.9%, while the 5-10 year outlook declined by 0.1 percentage points to 2.8%.There are numerous scheduled speeches from US Federal Reserve officials, with markets eagerly anticipating Fed Chair Powell's update next week.

Overnight Newswire Updates of Note

Congress Delays Government Shutdown For Another Week

Fed's Mester Still Expects Three Rate Cuts In 2024 After New Inflation Reading

Fed’s Daly: Officials ‘Ready’ To Cut Interest Rates When Data Demands It

Fed's Goolsbee: Jan Inflation Rebound Shouldn’t Overshadow Last Year's Progress

ECB’s Panetta Says Inflation Is Falling Faster Than Expected

UK Chancellor Leans Toward Retaining 5 Pence-Per-Litre UK Fuel Duty Cut

BoJ Chief Ueda Stops Short Of Declaring 2% Price Goal Met

RBNZ’s Orr: Inflation Is Still Too High But Is Falling

World Economy Has Growing Chance Of Soft Landing, G-20 Says

Japan’s Tight Labour Market To Keep Upward Pressure On Wages

South Korean Exports Rise For 5th Straight Month In February

Bank Of America, Wells Fargo To Offer Spot Bitcoin ETFs To Clients

Hewlett Packard Enterprise Q1 Revenue Drops On Server, Hybrid Cloud Hit

Dell Jumps On Server Sales Fuelled By Excitement For AI Work

Disney Family Rebukes Nelson Peltz, Praises Bob Iger In Shareholder Letters

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0865 (EU1.6b), 1.0800 (EU1.31b), 1.0850 (EU759m)

USD/JPY: 148.30 ($954.5m), 150.35 ($903.2m), 149.00 ($831m)

AUD/USD: 0.5855 (AUD780m), 0.6400 (AUD352.7m), 0.6370 (AUD300m)

USD/CAD: 1.3195 ($1.03b), 1.3310 ($706.8m), 1.3410 ($532m)

USD/CNY: 7.2500 ($758.4m), 7.4400 ($719.4m), 7.1000 ($302m)

GBP/USD: 1.1150 (GBP500m), 1.2500 (GBP406.8m)

CFTC Data As Of 20/02/24

Japanese Yen net short position is -120,778 contracts.

British Pound net long position is 46,312 contracts.

Euro net long position is 68,016 contracts

bitcoin net short position is -2,098 contracts.

Swiss Franc posts net short position of -9,923 contracts.

Equity Fund managers raise S&P 500 CME net long position by 17.027 contracts to 947,280.

Equity fund speculators increase S&P 500 CME net short position by 35.358 contracts to 419,832.

Technical & Trade Views

SP500 Bullish Above Bearish Below 5080

Daily VWAP bearish

Weekly VWAP bullish

Below 5030 opens 5000

Primary support 4940

Primary objective is 5120

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0950

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0950

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bearish

Weekly VWAP bullish

Below 1.26 opens 1.2550

Primary resistance is 1.2785

Primary objective 1.2830

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bearish

Weekly VWAP bullish

Below 1.26 opens 1.2550

Primary resistance is 1.2785

Primary objective 1.2830

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bearish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 152

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bearish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 152

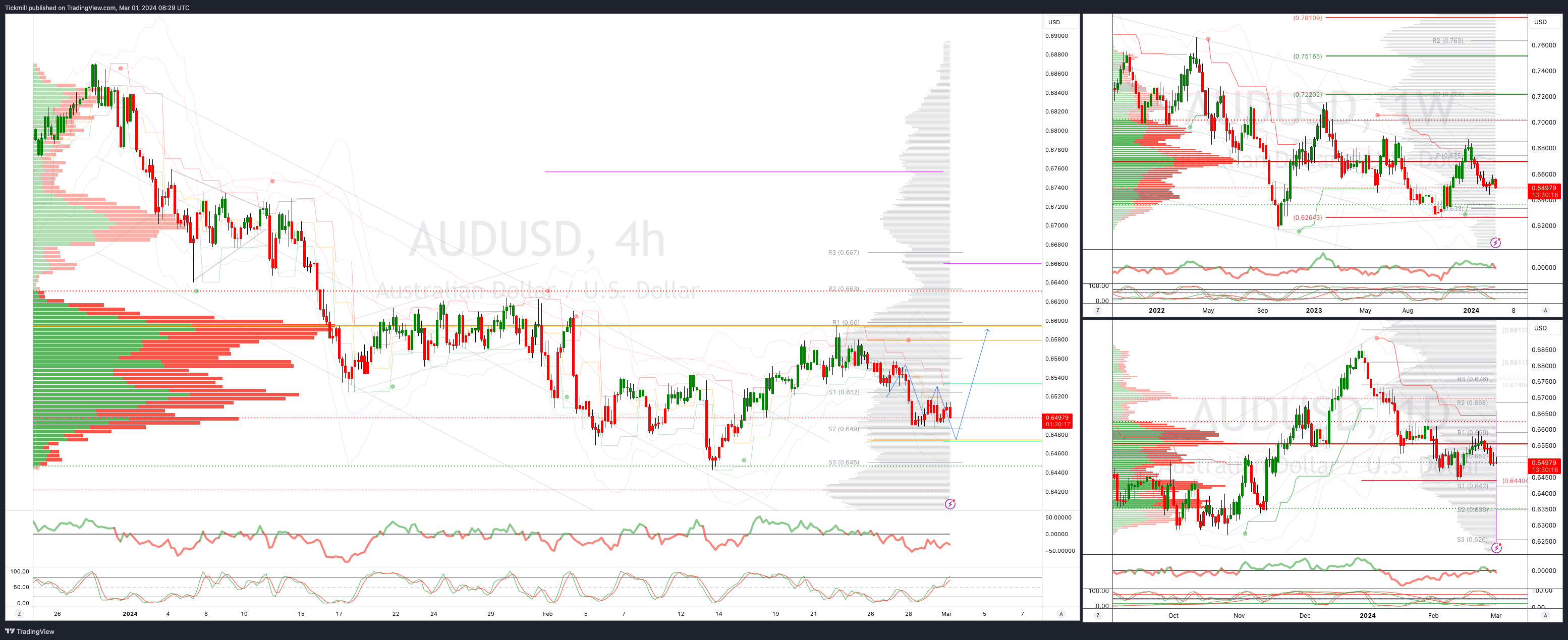

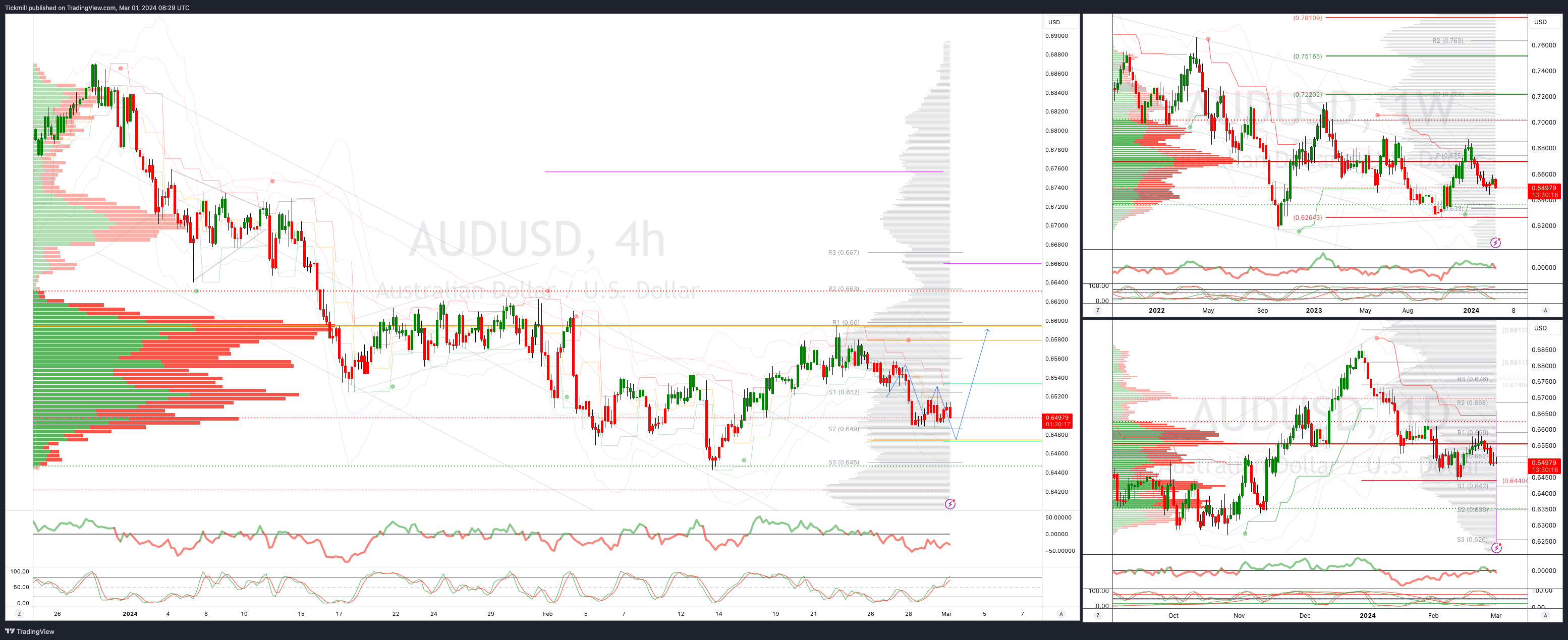

AUDUSD Bullish Above Bearish Below .6590

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6440

Primary support .6440

Primary objective is .6700

AUDUSD Bullish Above Bearish Below .6590

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6440

Primary support .6440

Primary objective is .6700

BTCUSD Bullish Above Bearish below 58400

Daily VWAP bullish

Weekly VWAP bullish

Below 58000 opens 53000

Primary support is 50000

Primary objective is 66000

BTCUSD Bullish Above Bearish below 58400

Daily VWAP bullish

Weekly VWAP bullish

Below 58000 opens 53000

Primary support is 50000

Primary objective is 66000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.Publication date:

2024-03-01 13:03:36 (GMT)

Munnelly’s Market Minute…

“The Nikkei Opens The New Month With A Surge To Record Highs”

The new month starts with Japan's Nikkei Average hitting a new high above the 40K handle, following the S&P 500 and Nasdaq closing at record highs on Thursday, driven by tech stocks related to AI. Nvidia, a major chipmaker, contributed significantly to the benchmark indexes, while Advanced Micro Devices, a smaller rival, also saw a surge. Most Asian equity markets are higher. China's composite PMI for February remained unchanged at 50.9, indicating weaker manufacturing but stronger growth in other areas. Bank of Japan Governor Ueda suggested that it would take time to determine if the price target had been met, hinting that an immediate interest rate hike is unlikely.

The Eurozone's February CPI inflation data is forecast to show a decline in annual headline inflation to 2.6% from 2.8% in January, primarily due to a decrease in core inflation to a 2-year low of 2.9% from 3.3%.Despite remaining above the 2.0% target, inflation is expected to fall further over the coming months, potentially leading to speculation about a rate cut by the European Central Bank in April.The Eurozone unemployment rate is expected to remain at a cyclical low of 6.4% in January, maintaining concerns about wage growth. The February Eurozone PMI manufacturing data is not expected to be revised significantly, remaining below the 50 expansionary level. In the UK, Bank of England Chief Economist Huw Pill is scheduled to speak.

Stateside,the US Congress passed a stop-gap measure to avoid a partial government shutdown, providing another week to agree on a comprehensive bill.The ISM manufacturing index for February is anticipated to show strength, with expectations of reaching 50 for the first time since late 2022. The University of Michigan sentiment data is expected to validate the headline sentiment of 79.6. Additionally, there will be a focus on the inflation indicators, as the preliminary data indicated that the 1-year outlook remained steady at 2.9%, while the 5-10 year outlook declined by 0.1 percentage points to 2.8%.There are numerous scheduled speeches from US Federal Reserve officials, with markets eagerly anticipating Fed Chair Powell's update next week.

Overnight Newswire Updates of Note

Congress Delays Government Shutdown For Another Week

Fed's Mester Still Expects Three Rate Cuts In 2024 After New Inflation Reading

Fed’s Daly: Officials ‘Ready’ To Cut Interest Rates When Data Demands It

Fed's Goolsbee: Jan Inflation Rebound Shouldn’t Overshadow Last Year's Progress

ECB’s Panetta Says Inflation Is Falling Faster Than Expected

UK Chancellor Leans Toward Retaining 5 Pence-Per-Litre UK Fuel Duty Cut

BoJ Chief Ueda Stops Short Of Declaring 2% Price Goal Met

RBNZ’s Orr: Inflation Is Still Too High But Is Falling

World Economy Has Growing Chance Of Soft Landing, G-20 Says

Japan’s Tight Labour Market To Keep Upward Pressure On Wages

South Korean Exports Rise For 5th Straight Month In February

Bank Of America, Wells Fargo To Offer Spot Bitcoin ETFs To Clients

Hewlett Packard Enterprise Q1 Revenue Drops On Server, Hybrid Cloud Hit

Dell Jumps On Server Sales Fuelled By Excitement For AI Work

Disney Family Rebukes Nelson Peltz, Praises Bob Iger In Shareholder Letters

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0865 (EU1.6b), 1.0800 (EU1.31b), 1.0850 (EU759m)

USD/JPY: 148.30 ($954.5m), 150.35 ($903.2m), 149.00 ($831m)

AUD/USD: 0.5855 (AUD780m), 0.6400 (AUD352.7m), 0.6370 (AUD300m)

USD/CAD: 1.3195 ($1.03b), 1.3310 ($706.8m), 1.3410 ($532m)

USD/CNY: 7.2500 ($758.4m), 7.4400 ($719.4m), 7.1000 ($302m)

GBP/USD: 1.1150 (GBP500m), 1.2500 (GBP406.8m)

CFTC Data As Of 20/02/24

Japanese Yen net short position is -120,778 contracts.

British Pound net long position is 46,312 contracts.

Euro net long position is 68,016 contracts

bitcoin net short position is -2,098 contracts.

Swiss Franc posts net short position of -9,923 contracts.

Equity Fund managers raise S&P 500 CME net long position by 17.027 contracts to 947,280.

Equity fund speculators increase S&P 500 CME net short position by 35.358 contracts to 419,832.

Technical & Trade Views

SP500 Bullish Above Bearish Below 5080

Daily VWAP bearish

Weekly VWAP bullish

Below 5030 opens 5000

Primary support 4940

Primary objective is 5120

Munnelly’s Market Minute…

“The Nikkei Opens The New Month With A Surge To Record Highs”

The new month starts with Japan's Nikkei Average hitting a new high above the 40K handle, following the S&P 500 and Nasdaq closing at record highs on Thursday, driven by tech stocks related to AI. Nvidia, a major chipmaker, contributed significantly to the benchmark indexes, while Advanced Micro Devices, a smaller rival, also saw a surge. Most Asian equity markets are higher. China's composite PMI for February remained unchanged at 50.9, indicating weaker manufacturing but stronger growth in other areas. Bank of Japan Governor Ueda suggested that it would take time to determine if the price target had been met, hinting that an immediate interest rate hike is unlikely.

The Eurozone's February CPI inflation data is forecast to show a decline in annual headline inflation to 2.6% from 2.8% in January, primarily due to a decrease in core inflation to a 2-year low of 2.9% from 3.3%.Despite remaining above the 2.0% target, inflation is expected to fall further over the coming months, potentially leading to speculation about a rate cut by the European Central Bank in April.The Eurozone unemployment rate is expected to remain at a cyclical low of 6.4% in January, maintaining concerns about wage growth. The February Eurozone PMI manufacturing data is not expected to be revised significantly, remaining below the 50 expansionary level. In the UK, Bank of England Chief Economist Huw Pill is scheduled to speak.

Stateside,the US Congress passed a stop-gap measure to avoid a partial government shutdown, providing another week to agree on a comprehensive bill.The ISM manufacturing index for February is anticipated to show strength, with expectations of reaching 50 for the first time since late 2022. The University of Michigan sentiment data is expected to validate the headline sentiment of 79.6. Additionally, there will be a focus on the inflation indicators, as the preliminary data indicated that the 1-year outlook remained steady at 2.9%, while the 5-10 year outlook declined by 0.1 percentage points to 2.8%.There are numerous scheduled speeches from US Federal Reserve officials, with markets eagerly anticipating Fed Chair Powell's update next week.

Overnight Newswire Updates of Note

Congress Delays Government Shutdown For Another Week

Fed's Mester Still Expects Three Rate Cuts In 2024 After New Inflation Reading

Fed’s Daly: Officials ‘Ready’ To Cut Interest Rates When Data Demands It

Fed's Goolsbee: Jan Inflation Rebound Shouldn’t Overshadow Last Year's Progress

ECB’s Panetta Says Inflation Is Falling Faster Than Expected

UK Chancellor Leans Toward Retaining 5 Pence-Per-Litre UK Fuel Duty Cut

BoJ Chief Ueda Stops Short Of Declaring 2% Price Goal Met

RBNZ’s Orr: Inflation Is Still Too High But Is Falling

World Economy Has Growing Chance Of Soft Landing, G-20 Says

Japan’s Tight Labour Market To Keep Upward Pressure On Wages

South Korean Exports Rise For 5th Straight Month In February

Bank Of America, Wells Fargo To Offer Spot Bitcoin ETFs To Clients

Hewlett Packard Enterprise Q1 Revenue Drops On Server, Hybrid Cloud Hit

Dell Jumps On Server Sales Fuelled By Excitement For AI Work

Disney Family Rebukes Nelson Peltz, Praises Bob Iger In Shareholder Letters

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

EUR/USD: 1.0865 (EU1.6b), 1.0800 (EU1.31b), 1.0850 (EU759m)

USD/JPY: 148.30 ($954.5m), 150.35 ($903.2m), 149.00 ($831m)

AUD/USD: 0.5855 (AUD780m), 0.6400 (AUD352.7m), 0.6370 (AUD300m)

USD/CAD: 1.3195 ($1.03b), 1.3310 ($706.8m), 1.3410 ($532m)

USD/CNY: 7.2500 ($758.4m), 7.4400 ($719.4m), 7.1000 ($302m)

GBP/USD: 1.1150 (GBP500m), 1.2500 (GBP406.8m)

CFTC Data As Of 20/02/24

Japanese Yen net short position is -120,778 contracts.

British Pound net long position is 46,312 contracts.

Euro net long position is 68,016 contracts

bitcoin net short position is -2,098 contracts.

Swiss Franc posts net short position of -9,923 contracts.

Equity Fund managers raise S&P 500 CME net long position by 17.027 contracts to 947,280.

Equity fund speculators increase S&P 500 CME net short position by 35.358 contracts to 419,832.

Technical & Trade Views

SP500 Bullish Above Bearish Below 5080

Daily VWAP bearish

Weekly VWAP bullish

Below 5030 opens 5000

Primary support 4940

Primary objective is 5120

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0950

EURUSD Bullish Above Bearish Below 1.08

Daily VWAP bullish

Weekly VWAP bullish

Above 1.0880 opens 1.0950

Primary resistance 1.0950

Primary objective is 1.0950

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bearish

Weekly VWAP bullish

Below 1.26 opens 1.2550

Primary resistance is 1.2785

Primary objective 1.2830

GBPUSD Bullish Above Bearish Below 1.2683

Daily VWAP bearish

Weekly VWAP bullish

Below 1.26 opens 1.2550

Primary resistance is 1.2785

Primary objective 1.2830

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bearish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 152

USDJPY Bullish Above Bearish Below 149.50

Daily VWAP bearish

Weekly VWAP bullish

Below 149.50 opens 148.70

Primary support 145.85

Primary objective is 152

AUDUSD Bullish Above Bearish Below .6590

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6440

Primary support .6440

Primary objective is .6700

AUDUSD Bullish Above Bearish Below .6590

Daily VWAP bearish

Weekly VWAP bearish

Below .6500 opens .6440

Primary support .6440

Primary objective is .6700

BTCUSD Bullish Above Bearish below 58400

Daily VWAP bullish

Weekly VWAP bullish

Below 58000 opens 53000

Primary support is 50000

Primary objective is 66000

BTCUSD Bullish Above Bearish below 58400

Daily VWAP bullish

Weekly VWAP bullish

Below 58000 opens 53000

Primary support is 50000

Primary objective is 66000

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.