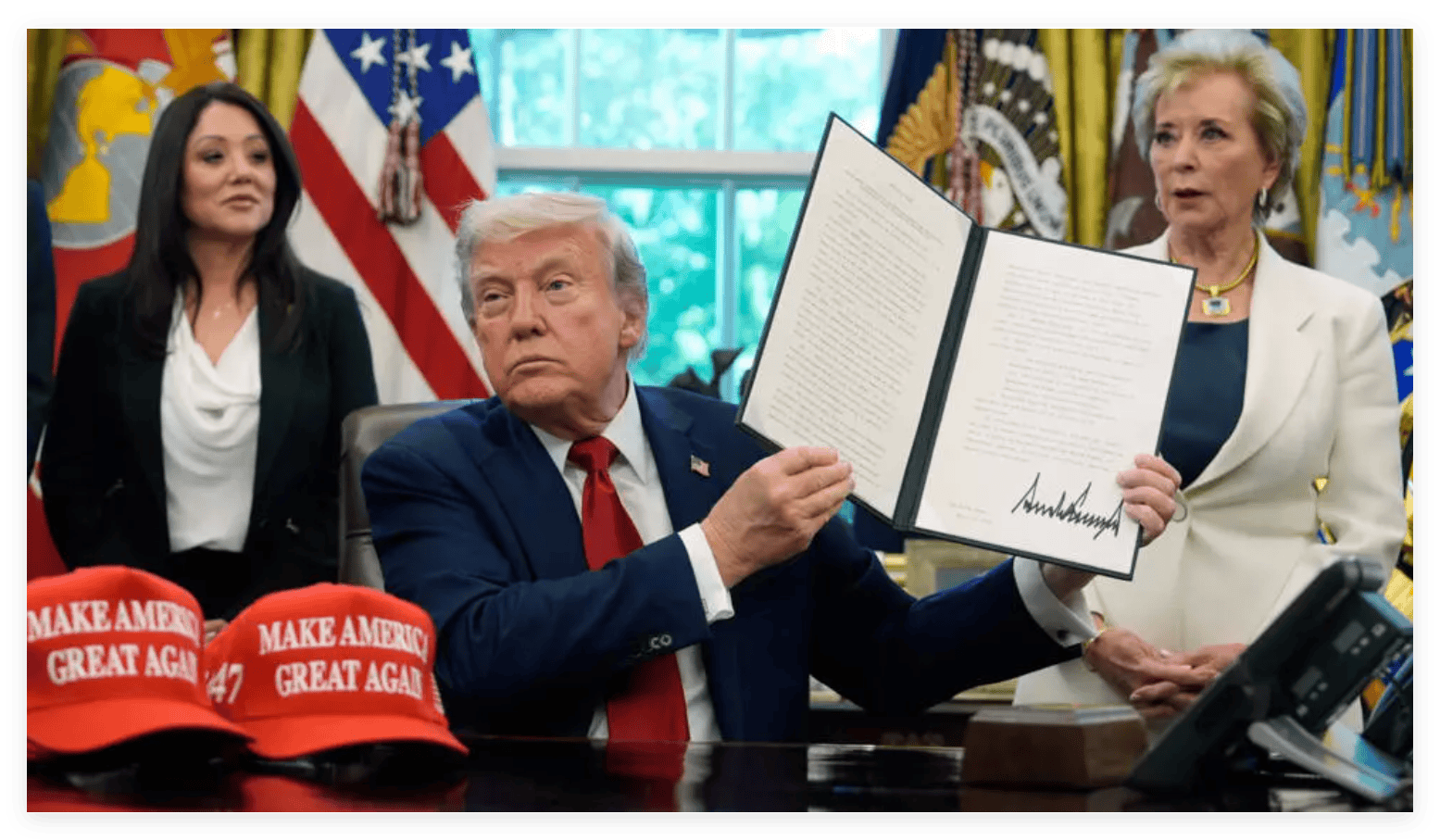

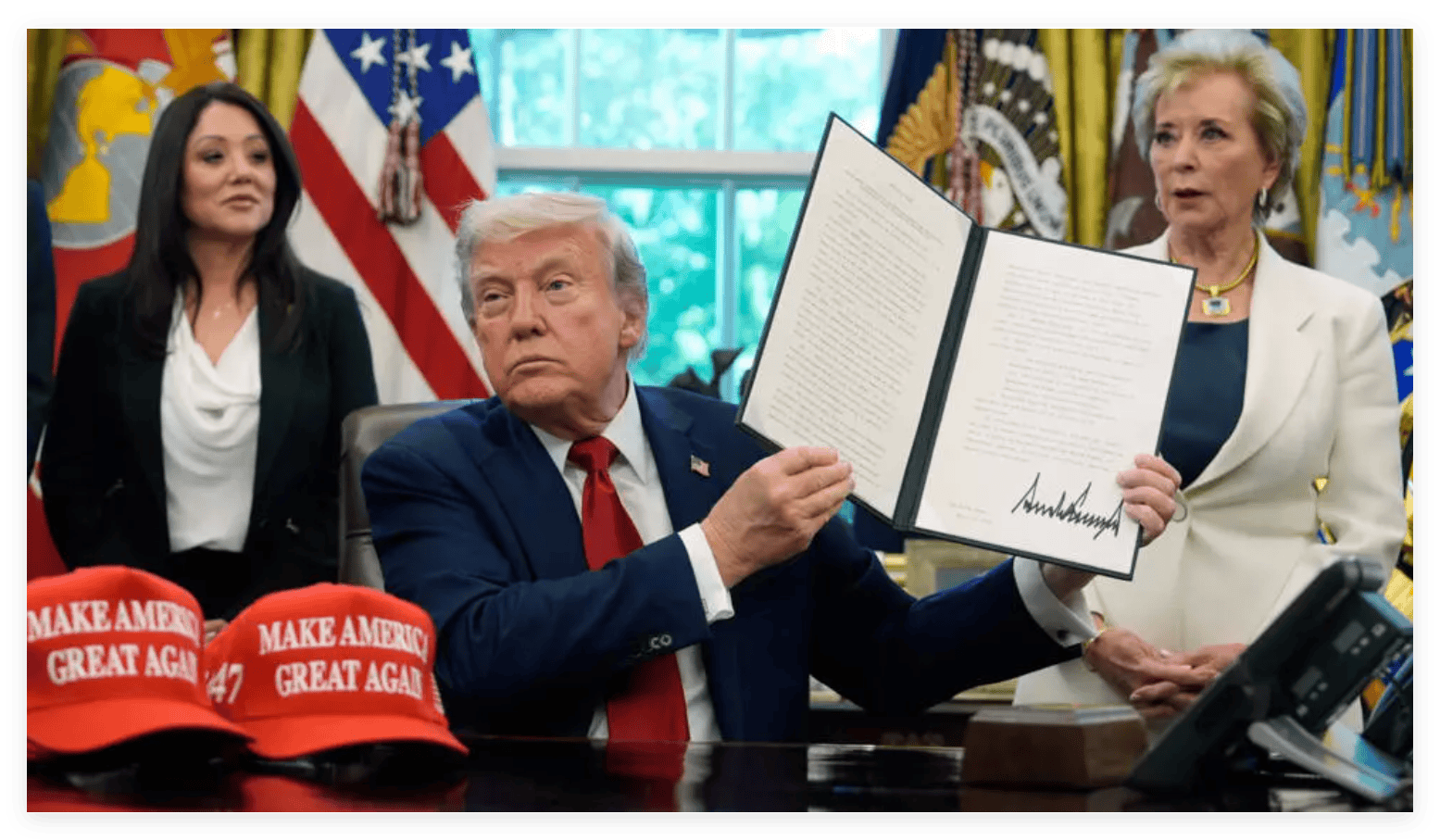

Currently, the market is relatively stable, influenced by recent significant developments. After President Trump announced a substantial reduction in tariffs on China, U.S. Treasury Secretary Steven Mnuchin stated last night that "America First" does not mean the U.S. acting alone, and the U.S. is willing to cooperate with its allies to reach various trade agreements. This marks a relaxation of Trump's comprehensive tariff policy, suggesting that tensions in U.S.-China trade relations may ease. The U.S. has started to cushion the chaos caused by Trump’s extreme policies, which has led to some market recovery.

U.S.-China Trade Focus: Tariff Negotiations

Currently, the market's focus is on the final outcome of the U.S.-China trade negotiations, particularly the final determination of tariff levels. Although Trump has stated that he will significantly reduce tariffs on China, certain tariffs will still be retained. The key issue is: what will the final tariff level be? If the U.S. and China reach an agreement on tariffs, and the level is below the previously expected 50%, the market is likely to respond positively.

However, if tariffs remain above 50%, U.S.-China trade will essentially be suspended, U.S. consumer prices will rise significantly, global economic prospects will deteriorate, and there will be a risk of an economic recession in the U.S. All these factors would negatively impact the market. Conversely, if the agreed tariff range is between 20% and 30%, lower than the market’s expectation of high tariffs, the market will send a more optimistic signal.

Market Response and Volatility

Although the market has rebounded, it is still waiting for the final results of the U.S.-China tariff negotiations. Overall, market volatility has started to subside and is gradually leaning towards consolidation. The market is waiting for further signals from the tariff agreement.

Gold Market Outlook

In the gold market, the price showed a slight downward trend yesterday, stabilizing around 3260. Today, buying activity in the Asian session has been relatively active, but the price has not broken through the key resistance area near 3380. Based on current market fundamentals, gold is expected to fluctuate within a range of approximately $50 above or below the 3300 level, waiting for further confirmation of market volatility signals.

The price of gold will be influenced by the trade negotiations and market sentiment. If tariffs remain high, it could lead to increased demand for gold as a safe-haven asset, pushing prices higher. If trade tensions ease and tariff levels are reduced, investors may turn to riskier assets, reducing gold’s appeal.

Conclusion

In conclusion, while the market has seen some rebound, it remains highly sensitive to the latest developments in U.S.-China trade negotiations. The results of the tariff talks will have a significant impact on market expectations for the coming weeks. In particular, gold prices are expected to fluctuate within a narrow range, with the market continuing to wait for further signals from trade talks. If the tariff agreement results in lower tariffs than previously expected, it could send positive signals to both the stock and commodity markets. However, if tariffs remain high, it could continue to put pressure on market sentiment.

Currently, the market is relatively stable, influenced by recent significant developments. After President Trump announced a substantial reduction in tariffs on China, U.S. Treasury Secretary Steven Mnuchin stated last night that "America First" does not mean the U.S. acting alone, and the U.S. is willing to cooperate with its allies to reach various trade agreements. This marks a relaxation of Trump's comprehensive tariff policy, suggesting that tensions in U.S.-China trade relations may ease. The U.S. has started to cushion the chaos caused by Trump’s extreme policies, which has led to some market recovery.

U.S.-China Trade Focus: Tariff Negotiations

Currently, the market's focus is on the final outcome of the U.S.-China trade negotiations, particularly the final determination of tariff levels. Although Trump has stated that he will significantly reduce tariffs on China, certain tariffs will still be retained. The key issue is: what will the final tariff level be? If the U.S. and China reach an agreement on tariffs, and the level is below the previously expected 50%, the market is likely to respond positively.

However, if tariffs remain above 50%, U.S.-China trade will essentially be suspended, U.S. consumer prices will rise significantly, global economic prospects will deteriorate, and there will be a risk of an economic recession in the U.S. All these factors would negatively impact the market. Conversely, if the agreed tariff range is between 20% and 30%, lower than the market’s expectation of high tariffs, the market will send a more optimistic signal.

Market Response and Volatility

Although the market has rebounded, it is still waiting for the final results of the U.S.-China tariff negotiations. Overall, market volatility has started to subside and is gradually leaning towards consolidation. The market is waiting for further signals from the tariff agreement.

Gold Market Outlook

In the gold market, the price showed a slight downward trend yesterday, stabilizing around 3260. Today, buying activity in the Asian session has been relatively active, but the price has not broken through the key resistance area near 3380. Based on current market fundamentals, gold is expected to fluctuate within a range of approximately $50 above or below the 3300 level, waiting for further confirmation of market volatility signals.

The price of gold will be influenced by the trade negotiations and market sentiment. If tariffs remain high, it could lead to increased demand for gold as a safe-haven asset, pushing prices higher. If trade tensions ease and tariff levels are reduced, investors may turn to riskier assets, reducing gold’s appeal.

Conclusion

In conclusion, while the market has seen some rebound, it remains highly sensitive to the latest developments in U.S.-China trade negotiations. The results of the tariff talks will have a significant impact on market expectations for the coming weeks. In particular, gold prices are expected to fluctuate within a narrow range, with the market continuing to wait for further signals from trade talks. If the tariff agreement results in lower tariffs than previously expected, it could send positive signals to both the stock and commodity markets. However, if tariffs remain high, it could continue to put pressure on market sentiment.OEXN U.S.-China Trade Relations and Gold Price Outlook

Currently, the market is relatively stable, influenced by recent significant developments. After President Trump announced a substantial reduction in tariffs on China, U.S. Treasury Secretary Steven Mnuchin stated last night that "America First" does not mean the U.S. acting alone, and the U.S. is willing to cooperate with its allies to reach various trade agreements. This marks a relaxation of Trump's comprehensive tariff policy, suggesting that tensions in U.S.-China trade relations may ease. The U.S. has started to cushion the chaos caused by Trump’s extreme policies, which has led to some market recovery.

U.S.-China Trade Focus: Tariff Negotiations

Currently, the market's focus is on the final outcome of the U.S.-China trade negotiations, particularly the final determination of tariff levels. Although Trump has stated that he will significantly reduce tariffs on China, certain tariffs will still be retained. The key issue is: what will the final tariff level be? If the U.S. and China reach an agreement on tariffs, and the level is below the previously expected 50%, the market is likely to respond positively.

However, if tariffs remain above 50%, U.S.-China trade will essentially be suspended, U.S. consumer prices will rise significantly, global economic prospects will deteriorate, and there will be a risk of an economic recession in the U.S. All these factors would negatively impact the market. Conversely, if the agreed tariff range is between 20% and 30%, lower than the market’s expectation of high tariffs, the market will send a more optimistic signal.

Market Response and Volatility

Although the market has rebounded, it is still waiting for the final results of the U.S.-China tariff negotiations. Overall, market volatility has started to subside and is gradually leaning towards consolidation. The market is waiting for further signals from the tariff agreement.

Gold Market Outlook

In the gold market, the price showed a slight downward trend yesterday, stabilizing around 3260. Today, buying activity in the Asian session has been relatively active, but the price has not broken through the key resistance area near 3380. Based on current market fundamentals, gold is expected to fluctuate within a range of approximately $50 above or below the 3300 level, waiting for further confirmation of market volatility signals.

The price of gold will be influenced by the trade negotiations and market sentiment. If tariffs remain high, it could lead to increased demand for gold as a safe-haven asset, pushing prices higher. If trade tensions ease and tariff levels are reduced, investors may turn to riskier assets, reducing gold’s appeal.

Conclusion

In conclusion, while the market has seen some rebound, it remains highly sensitive to the latest developments in U.S.-China trade negotiations. The results of the tariff talks will have a significant impact on market expectations for the coming weeks. In particular, gold prices are expected to fluctuate within a narrow range, with the market continuing to wait for further signals from trade talks. If the tariff agreement results in lower tariffs than previously expected, it could send positive signals to both the stock and commodity markets. However, if tariffs remain high, it could continue to put pressure on market sentiment.

Currently, the market is relatively stable, influenced by recent significant developments. After President Trump announced a substantial reduction in tariffs on China, U.S. Treasury Secretary Steven Mnuchin stated last night that "America First" does not mean the U.S. acting alone, and the U.S. is willing to cooperate with its allies to reach various trade agreements. This marks a relaxation of Trump's comprehensive tariff policy, suggesting that tensions in U.S.-China trade relations may ease. The U.S. has started to cushion the chaos caused by Trump’s extreme policies, which has led to some market recovery.

U.S.-China Trade Focus: Tariff Negotiations

Currently, the market's focus is on the final outcome of the U.S.-China trade negotiations, particularly the final determination of tariff levels. Although Trump has stated that he will significantly reduce tariffs on China, certain tariffs will still be retained. The key issue is: what will the final tariff level be? If the U.S. and China reach an agreement on tariffs, and the level is below the previously expected 50%, the market is likely to respond positively.

However, if tariffs remain above 50%, U.S.-China trade will essentially be suspended, U.S. consumer prices will rise significantly, global economic prospects will deteriorate, and there will be a risk of an economic recession in the U.S. All these factors would negatively impact the market. Conversely, if the agreed tariff range is between 20% and 30%, lower than the market’s expectation of high tariffs, the market will send a more optimistic signal.

Market Response and Volatility

Although the market has rebounded, it is still waiting for the final results of the U.S.-China tariff negotiations. Overall, market volatility has started to subside and is gradually leaning towards consolidation. The market is waiting for further signals from the tariff agreement.

Gold Market Outlook

In the gold market, the price showed a slight downward trend yesterday, stabilizing around 3260. Today, buying activity in the Asian session has been relatively active, but the price has not broken through the key resistance area near 3380. Based on current market fundamentals, gold is expected to fluctuate within a range of approximately $50 above or below the 3300 level, waiting for further confirmation of market volatility signals.

The price of gold will be influenced by the trade negotiations and market sentiment. If tariffs remain high, it could lead to increased demand for gold as a safe-haven asset, pushing prices higher. If trade tensions ease and tariff levels are reduced, investors may turn to riskier assets, reducing gold’s appeal.

Conclusion

In conclusion, while the market has seen some rebound, it remains highly sensitive to the latest developments in U.S.-China trade negotiations. The results of the tariff talks will have a significant impact on market expectations for the coming weeks. In particular, gold prices are expected to fluctuate within a narrow range, with the market continuing to wait for further signals from trade talks. If the tariff agreement results in lower tariffs than previously expected, it could send positive signals to both the stock and commodity markets. However, if tariffs remain high, it could continue to put pressure on market sentiment.Publication date:

2025-04-28 10:38:40 (GMT)