Key market news and statistics:

-Trump revealed sweeping tariffs, dumping the financial markets into chaos

-NFP increased by 228K, far more than expected. Unemployment rate up to 4.2% y/y

-Hong Kong Hang Seng Index plunges -13.2% – the worst day since 1997

-US inflation rate on April 10

-Gold exits the overbought zone

Gold

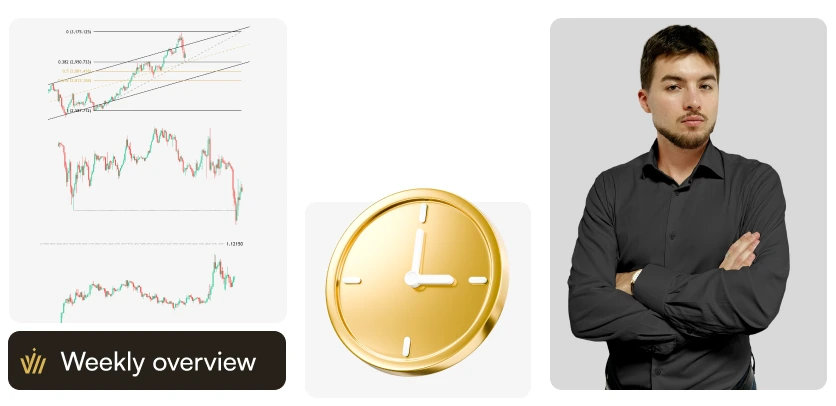

We warned you that #XAUUSD has shown signs of a correction underway, after the precious metal reached another ATH on the tariff reveal on April 2. Now, with global markets in chaos and crashing down almost without retracements, gold’s little -3.50% loss looks like the traditional safe haven investors seek in times of crisis.

Last week, we provided you with entry signals, but the enormous volatility completed all three of them in under two hours, allowing traders to take advantage of a great profit-generating move. This week, gold’s appeal remains subdued, at least until new tariff escalation hits the global headlines. The key day for a turnaround might be April 10, with the US inflation rate on the way. For now, XAUUSD is expected to continue weakening or consolidating, after reaching the Fibonacci Golden Zone earlier on April 7. Price targets vary from a short one ($2920/oz) to a long one, in case the situation worsens further ($3100/oz).

Bitcoin

Bitcoin crashed in the weekend, after holding firm on broader market panic. Finally, the speculative nature of the asset took over, plunging the crypto pair as low as $74,400. If the global trade war continues escalating, no light may shine on #BTCUSD, leading to further downside.

BTCUSD has completed our month-old short target. Now, if it manages to fall and close below $76,500m the road to $66,000 might be paved. Consider only short plays in these uncertain times.

EURUSD

The Fiber had a better week if compared to other global assets, ending the week 1.5% higher. We warned you, that such a move is the direct result of USD weakening, not of EUR strengthening, and medium-term economic data might cool off the rally if it starts to hint at problems in the Eurozone’s economy.

The long scenario is dominant at the moment, with our price target standing at 1.12150. The EU plans to retaliate against Trump’s tariffs, further escalating the conflict. The consequences of such a move might be disastrous for Europe’s industrial sector. This is the reason why we advise caution when trading #EURUSD this week – always use a Stop-Loss!

Key market news and statistics:

-Trump revealed sweeping tariffs, dumping the financial markets into chaos

-NFP increased by 228K, far more than expected. Unemployment rate up to 4.2% y/y

-Hong Kong Hang Seng Index plunges -13.2% – the worst day since 1997

-US inflation rate on April 10

-Gold exits the overbought zone

Gold

We warned you that #XAUUSD has shown signs of a correction underway, after the precious metal reached another ATH on the tariff reveal on April 2. Now, with global markets in chaos and crashing down almost without retracements, gold’s little -3.50% loss looks like the traditional safe haven investors seek in times of crisis.

Last week, we provided you with entry signals, but the enormous volatility completed all three of them in under two hours, allowing traders to take advantage of a great profit-generating move. This week, gold’s appeal remains subdued, at least until new tariff escalation hits the global headlines. The key day for a turnaround might be April 10, with the US inflation rate on the way. For now, XAUUSD is expected to continue weakening or consolidating, after reaching the Fibonacci Golden Zone earlier on April 7. Price targets vary from a short one ($2920/oz) to a long one, in case the situation worsens further ($3100/oz).

Bitcoin

Bitcoin crashed in the weekend, after holding firm on broader market panic. Finally, the speculative nature of the asset took over, plunging the crypto pair as low as $74,400. If the global trade war continues escalating, no light may shine on #BTCUSD, leading to further downside.

BTCUSD has completed our month-old short target. Now, if it manages to fall and close below $76,500m the road to $66,000 might be paved. Consider only short plays in these uncertain times.

EURUSD

The Fiber had a better week if compared to other global assets, ending the week 1.5% higher. We warned you, that such a move is the direct result of USD weakening, not of EUR strengthening, and medium-term economic data might cool off the rally if it starts to hint at problems in the Eurozone’s economy.

The long scenario is dominant at the moment, with our price target standing at 1.12150. The EU plans to retaliate against Trump’s tariffs, further escalating the conflict. The consequences of such a move might be disastrous for Europe’s industrial sector. This is the reason why we advise caution when trading #EURUSD this week – always use a Stop-Loss!Market Weekly Overview | April 8

Key market news and statistics:

-Trump revealed sweeping tariffs, dumping the financial markets into chaos

-NFP increased by 228K, far more than expected. Unemployment rate up to 4.2% y/y

-Hong Kong Hang Seng Index plunges -13.2% – the worst day since 1997

-US inflation rate on April 10

-Gold exits the overbought zone

Gold

We warned you that #XAUUSD has shown signs of a correction underway, after the precious metal reached another ATH on the tariff reveal on April 2. Now, with global markets in chaos and crashing down almost without retracements, gold’s little -3.50% loss looks like the traditional safe haven investors seek in times of crisis.

Last week, we provided you with entry signals, but the enormous volatility completed all three of them in under two hours, allowing traders to take advantage of a great profit-generating move. This week, gold’s appeal remains subdued, at least until new tariff escalation hits the global headlines. The key day for a turnaround might be April 10, with the US inflation rate on the way. For now, XAUUSD is expected to continue weakening or consolidating, after reaching the Fibonacci Golden Zone earlier on April 7. Price targets vary from a short one ($2920/oz) to a long one, in case the situation worsens further ($3100/oz).

Bitcoin

Bitcoin crashed in the weekend, after holding firm on broader market panic. Finally, the speculative nature of the asset took over, plunging the crypto pair as low as $74,400. If the global trade war continues escalating, no light may shine on #BTCUSD, leading to further downside.

BTCUSD has completed our month-old short target. Now, if it manages to fall and close below $76,500m the road to $66,000 might be paved. Consider only short plays in these uncertain times.

EURUSD

The Fiber had a better week if compared to other global assets, ending the week 1.5% higher. We warned you, that such a move is the direct result of USD weakening, not of EUR strengthening, and medium-term economic data might cool off the rally if it starts to hint at problems in the Eurozone’s economy.

The long scenario is dominant at the moment, with our price target standing at 1.12150. The EU plans to retaliate against Trump’s tariffs, further escalating the conflict. The consequences of such a move might be disastrous for Europe’s industrial sector. This is the reason why we advise caution when trading #EURUSD this week – always use a Stop-Loss!

Key market news and statistics:

-Trump revealed sweeping tariffs, dumping the financial markets into chaos

-NFP increased by 228K, far more than expected. Unemployment rate up to 4.2% y/y

-Hong Kong Hang Seng Index plunges -13.2% – the worst day since 1997

-US inflation rate on April 10

-Gold exits the overbought zone

Gold

We warned you that #XAUUSD has shown signs of a correction underway, after the precious metal reached another ATH on the tariff reveal on April 2. Now, with global markets in chaos and crashing down almost without retracements, gold’s little -3.50% loss looks like the traditional safe haven investors seek in times of crisis.

Last week, we provided you with entry signals, but the enormous volatility completed all three of them in under two hours, allowing traders to take advantage of a great profit-generating move. This week, gold’s appeal remains subdued, at least until new tariff escalation hits the global headlines. The key day for a turnaround might be April 10, with the US inflation rate on the way. For now, XAUUSD is expected to continue weakening or consolidating, after reaching the Fibonacci Golden Zone earlier on April 7. Price targets vary from a short one ($2920/oz) to a long one, in case the situation worsens further ($3100/oz).

Bitcoin

Bitcoin crashed in the weekend, after holding firm on broader market panic. Finally, the speculative nature of the asset took over, plunging the crypto pair as low as $74,400. If the global trade war continues escalating, no light may shine on #BTCUSD, leading to further downside.

BTCUSD has completed our month-old short target. Now, if it manages to fall and close below $76,500m the road to $66,000 might be paved. Consider only short plays in these uncertain times.

EURUSD

The Fiber had a better week if compared to other global assets, ending the week 1.5% higher. We warned you, that such a move is the direct result of USD weakening, not of EUR strengthening, and medium-term economic data might cool off the rally if it starts to hint at problems in the Eurozone’s economy.

The long scenario is dominant at the moment, with our price target standing at 1.12150. The EU plans to retaliate against Trump’s tariffs, further escalating the conflict. The consequences of such a move might be disastrous for Europe’s industrial sector. This is the reason why we advise caution when trading #EURUSD this week – always use a Stop-Loss!Publication date:

2025-04-08 09:14:25 (GMT)