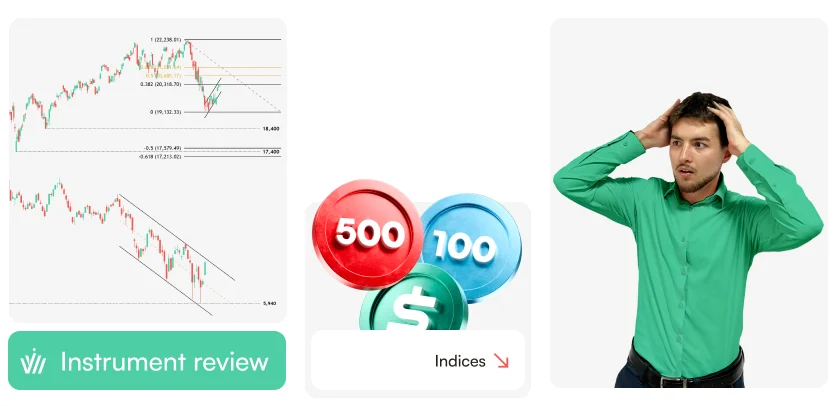

As a result, the #NASDAQ-100 find its way to the upside, but in this index wild swings like this are the norm. For example, at the beginning of the 2022 bear market, the tech-heavy US index crashed -15% in one month, only to then rebound +10% in 2 weeks. Ultimately though, the market continued to the downside for the whole year, losing -37%.

For American indices the path remains the same, with April 2 as the key date to monitor. If these “exceptions” Trump is speaking about will be big, the index might return to a bullish rally. Conversely, its course lies to the downside.

At the same time the Jakarta’s #COMPOSITE reached the 5,940 points support we designed as our short target. Immediately after it bounced back, with traders becoming slightly more optimistic on a possible Bank of Indonesia intervention in support of the banking sector and the rupiah. The Bank Central Asia (#BBCA) and Bank Rakyat Indonesia (#BBRI) stocks, which are also available on Headway, led the recovery.

Here, the bounce might also be technical. The economic outlook for Indonesia remains at odds with concerns over long term fiscal stability, with incoming possible tariff hikes and USD strengthening still posing a threat to the country’s financial markets.

As a result, we can only tell you this – watch out for April 2 tariff news and plan your next move!

In case a trade war escalation happens, the targets for the NASDAQ-100 remain at 18,400 and 17,400 points, while the COMPOSITE might lower to 5,750 (for starters…)

As a result, the #NASDAQ-100 find its way to the upside, but in this index wild swings like this are the norm. For example, at the beginning of the 2022 bear market, the tech-heavy US index crashed -15% in one month, only to then rebound +10% in 2 weeks. Ultimately though, the market continued to the downside for the whole year, losing -37%.

For American indices the path remains the same, with April 2 as the key date to monitor. If these “exceptions” Trump is speaking about will be big, the index might return to a bullish rally. Conversely, its course lies to the downside.

At the same time the Jakarta’s #COMPOSITE reached the 5,940 points support we designed as our short target. Immediately after it bounced back, with traders becoming slightly more optimistic on a possible Bank of Indonesia intervention in support of the banking sector and the rupiah. The Bank Central Asia (#BBCA) and Bank Rakyat Indonesia (#BBRI) stocks, which are also available on Headway, led the recovery.

Here, the bounce might also be technical. The economic outlook for Indonesia remains at odds with concerns over long term fiscal stability, with incoming possible tariff hikes and USD strengthening still posing a threat to the country’s financial markets.

As a result, we can only tell you this – watch out for April 2 tariff news and plan your next move!

In case a trade war escalation happens, the targets for the NASDAQ-100 remain at 18,400 and 17,400 points, while the COMPOSITE might lower to 5,750 (for starters…)Stock Indices Rebound, Waiting for April 2

As a result, the #NASDAQ-100 find its way to the upside, but in this index wild swings like this are the norm. For example, at the beginning of the 2022 bear market, the tech-heavy US index crashed -15% in one month, only to then rebound +10% in 2 weeks. Ultimately though, the market continued to the downside for the whole year, losing -37%.

For American indices the path remains the same, with April 2 as the key date to monitor. If these “exceptions” Trump is speaking about will be big, the index might return to a bullish rally. Conversely, its course lies to the downside.

At the same time the Jakarta’s #COMPOSITE reached the 5,940 points support we designed as our short target. Immediately after it bounced back, with traders becoming slightly more optimistic on a possible Bank of Indonesia intervention in support of the banking sector and the rupiah. The Bank Central Asia (#BBCA) and Bank Rakyat Indonesia (#BBRI) stocks, which are also available on Headway, led the recovery.

Here, the bounce might also be technical. The economic outlook for Indonesia remains at odds with concerns over long term fiscal stability, with incoming possible tariff hikes and USD strengthening still posing a threat to the country’s financial markets.

As a result, we can only tell you this – watch out for April 2 tariff news and plan your next move!

In case a trade war escalation happens, the targets for the NASDAQ-100 remain at 18,400 and 17,400 points, while the COMPOSITE might lower to 5,750 (for starters…)

As a result, the #NASDAQ-100 find its way to the upside, but in this index wild swings like this are the norm. For example, at the beginning of the 2022 bear market, the tech-heavy US index crashed -15% in one month, only to then rebound +10% in 2 weeks. Ultimately though, the market continued to the downside for the whole year, losing -37%.

For American indices the path remains the same, with April 2 as the key date to monitor. If these “exceptions” Trump is speaking about will be big, the index might return to a bullish rally. Conversely, its course lies to the downside.

At the same time the Jakarta’s #COMPOSITE reached the 5,940 points support we designed as our short target. Immediately after it bounced back, with traders becoming slightly more optimistic on a possible Bank of Indonesia intervention in support of the banking sector and the rupiah. The Bank Central Asia (#BBCA) and Bank Rakyat Indonesia (#BBRI) stocks, which are also available on Headway, led the recovery.

Here, the bounce might also be technical. The economic outlook for Indonesia remains at odds with concerns over long term fiscal stability, with incoming possible tariff hikes and USD strengthening still posing a threat to the country’s financial markets.

As a result, we can only tell you this – watch out for April 2 tariff news and plan your next move!

In case a trade war escalation happens, the targets for the NASDAQ-100 remain at 18,400 and 17,400 points, while the COMPOSITE might lower to 5,750 (for starters…)Publication date:

2025-03-26 10:35:03 (GMT)