Key market news and statistics:

-Russia-US peace talks in Saudi Arabia, after energy infrastructure ceasefire broken

-Israel set to launch new ground operations in Gaza: the war escalates

-The Fed held the interest rate steady last week, forecasting slower growth, higher inflation and using more dovish tones. Trump doubles down, urging rate cuts.

-Warren Buffet unloads some cash reserves, buying Japanese stocks

-EU’s HCOB Manufacturing PMI shows resilience on Monday 24

-Tariffs still weigh on markets, as traders brace for April 2

Gold

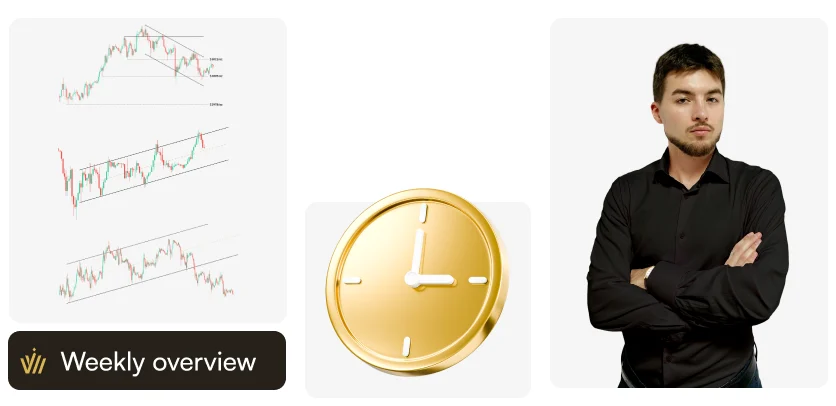

Last week #XAUUSD edged higher on the Fed's decision to hold rates steady, reaching a new ATH of $3057/oz. After that, the metal proceeded to cool down a bit, showing the first red daily candle in a week. As a result, gold’s price slid to $2999/oz, completing our retracement scenario we told you about. It bounced back up soon after, awaiting new triggers to decide whether to continue the correction towards $2975/oz or resume the rally.

This week, geopolitics might be the main catalyst for the metal, with Israel’s action likely to provide further bullish momentum, while Russia-US peace talks results are to be released today at 10:00 MT Time. For this reason, our near-term outlook remains the same: below $3000/oz lies the path to $2975/oz, while any breakout above $3040/oz will likely bring back the bulls at the helm. You can use any dip below $3000/oz to add to your long position. The dominating scenario remains bullish.

Bitcoin

Bitcoin's bearish momentum stopped in the first half of last week after the release of inflation data and the Fed decision brought more hopes of easing to the markets. Moreover, Trump’s speech at yet another crypto conference, while adding nothing new to already broadly known fundamentals, seems to have reignited the strengths of the buyers. Bitcoin traded at $87000 on Monday, March 24.

As a result, BTCUSD is now following an upwardly inclined channel, depicting a strong technical trend. You can trade the crypto pair short from the upper edge, long from the lower edge, and use breakouts as turning points in Bitcoin’s newfound rise. If the channel is broken to the upside, further bullish momentum might be expected.

EURUSD

Last week, the Fiber broke down of the upward channel we showed you, preceding lower and taking a breather in a local consolidation after not even the ECB rate cut managed to stop the rally. While fundamentals aren’t too bearish for the pair right now, traders are optimistically betting long on the Union’s plans to detach military and economic needs from the US. The HCOB Manufacturing PMI also showed stronger-than-expected growth (48.3 vs forecast 47 and last 46.5), reflecting this newfound optimism.

In the long term, however, we at Headway are still skeptical about the European Union’s economic and military potential, especially if tensions with Russia do not stop. A confirmation of that stands in the proposed “Savings and Investment Union” – a European Commission’s initiative to basically dispose of private savings freely, to fuel the rearmament. If the Union has to take from the private citizens, maybe the economy is not feeling so well after all. Technicals now speak of a retracement to the downside, but many factors are at stake – the Russia-US peace talk dynamics first among them. For now, you can look for short positions, targeting 1.06600, which stands at the Fibonacci Golden Zone.

Key market news and statistics:

-Russia-US peace talks in Saudi Arabia, after energy infrastructure ceasefire broken

-Israel set to launch new ground operations in Gaza: the war escalates

-The Fed held the interest rate steady last week, forecasting slower growth, higher inflation and using more dovish tones. Trump doubles down, urging rate cuts.

-Warren Buffet unloads some cash reserves, buying Japanese stocks

-EU’s HCOB Manufacturing PMI shows resilience on Monday 24

-Tariffs still weigh on markets, as traders brace for April 2

Gold

Last week #XAUUSD edged higher on the Fed's decision to hold rates steady, reaching a new ATH of $3057/oz. After that, the metal proceeded to cool down a bit, showing the first red daily candle in a week. As a result, gold’s price slid to $2999/oz, completing our retracement scenario we told you about. It bounced back up soon after, awaiting new triggers to decide whether to continue the correction towards $2975/oz or resume the rally.

This week, geopolitics might be the main catalyst for the metal, with Israel’s action likely to provide further bullish momentum, while Russia-US peace talks results are to be released today at 10:00 MT Time. For this reason, our near-term outlook remains the same: below $3000/oz lies the path to $2975/oz, while any breakout above $3040/oz will likely bring back the bulls at the helm. You can use any dip below $3000/oz to add to your long position. The dominating scenario remains bullish.

Bitcoin

Bitcoin's bearish momentum stopped in the first half of last week after the release of inflation data and the Fed decision brought more hopes of easing to the markets. Moreover, Trump’s speech at yet another crypto conference, while adding nothing new to already broadly known fundamentals, seems to have reignited the strengths of the buyers. Bitcoin traded at $87000 on Monday, March 24.

As a result, BTCUSD is now following an upwardly inclined channel, depicting a strong technical trend. You can trade the crypto pair short from the upper edge, long from the lower edge, and use breakouts as turning points in Bitcoin’s newfound rise. If the channel is broken to the upside, further bullish momentum might be expected.

EURUSD

Last week, the Fiber broke down of the upward channel we showed you, preceding lower and taking a breather in a local consolidation after not even the ECB rate cut managed to stop the rally. While fundamentals aren’t too bearish for the pair right now, traders are optimistically betting long on the Union’s plans to detach military and economic needs from the US. The HCOB Manufacturing PMI also showed stronger-than-expected growth (48.3 vs forecast 47 and last 46.5), reflecting this newfound optimism.

In the long term, however, we at Headway are still skeptical about the European Union’s economic and military potential, especially if tensions with Russia do not stop. A confirmation of that stands in the proposed “Savings and Investment Union” – a European Commission’s initiative to basically dispose of private savings freely, to fuel the rearmament. If the Union has to take from the private citizens, maybe the economy is not feeling so well after all. Technicals now speak of a retracement to the downside, but many factors are at stake – the Russia-US peace talk dynamics first among them. For now, you can look for short positions, targeting 1.06600, which stands at the Fibonacci Golden Zone.Market Weekly Overview | March 25

Key market news and statistics:

-Russia-US peace talks in Saudi Arabia, after energy infrastructure ceasefire broken

-Israel set to launch new ground operations in Gaza: the war escalates

-The Fed held the interest rate steady last week, forecasting slower growth, higher inflation and using more dovish tones. Trump doubles down, urging rate cuts.

-Warren Buffet unloads some cash reserves, buying Japanese stocks

-EU’s HCOB Manufacturing PMI shows resilience on Monday 24

-Tariffs still weigh on markets, as traders brace for April 2

Gold

Last week #XAUUSD edged higher on the Fed's decision to hold rates steady, reaching a new ATH of $3057/oz. After that, the metal proceeded to cool down a bit, showing the first red daily candle in a week. As a result, gold’s price slid to $2999/oz, completing our retracement scenario we told you about. It bounced back up soon after, awaiting new triggers to decide whether to continue the correction towards $2975/oz or resume the rally.

This week, geopolitics might be the main catalyst for the metal, with Israel’s action likely to provide further bullish momentum, while Russia-US peace talks results are to be released today at 10:00 MT Time. For this reason, our near-term outlook remains the same: below $3000/oz lies the path to $2975/oz, while any breakout above $3040/oz will likely bring back the bulls at the helm. You can use any dip below $3000/oz to add to your long position. The dominating scenario remains bullish.

Bitcoin

Bitcoin's bearish momentum stopped in the first half of last week after the release of inflation data and the Fed decision brought more hopes of easing to the markets. Moreover, Trump’s speech at yet another crypto conference, while adding nothing new to already broadly known fundamentals, seems to have reignited the strengths of the buyers. Bitcoin traded at $87000 on Monday, March 24.

As a result, BTCUSD is now following an upwardly inclined channel, depicting a strong technical trend. You can trade the crypto pair short from the upper edge, long from the lower edge, and use breakouts as turning points in Bitcoin’s newfound rise. If the channel is broken to the upside, further bullish momentum might be expected.

EURUSD

Last week, the Fiber broke down of the upward channel we showed you, preceding lower and taking a breather in a local consolidation after not even the ECB rate cut managed to stop the rally. While fundamentals aren’t too bearish for the pair right now, traders are optimistically betting long on the Union’s plans to detach military and economic needs from the US. The HCOB Manufacturing PMI also showed stronger-than-expected growth (48.3 vs forecast 47 and last 46.5), reflecting this newfound optimism.

In the long term, however, we at Headway are still skeptical about the European Union’s economic and military potential, especially if tensions with Russia do not stop. A confirmation of that stands in the proposed “Savings and Investment Union” – a European Commission’s initiative to basically dispose of private savings freely, to fuel the rearmament. If the Union has to take from the private citizens, maybe the economy is not feeling so well after all. Technicals now speak of a retracement to the downside, but many factors are at stake – the Russia-US peace talk dynamics first among them. For now, you can look for short positions, targeting 1.06600, which stands at the Fibonacci Golden Zone.

Key market news and statistics:

-Russia-US peace talks in Saudi Arabia, after energy infrastructure ceasefire broken

-Israel set to launch new ground operations in Gaza: the war escalates

-The Fed held the interest rate steady last week, forecasting slower growth, higher inflation and using more dovish tones. Trump doubles down, urging rate cuts.

-Warren Buffet unloads some cash reserves, buying Japanese stocks

-EU’s HCOB Manufacturing PMI shows resilience on Monday 24

-Tariffs still weigh on markets, as traders brace for April 2

Gold

Last week #XAUUSD edged higher on the Fed's decision to hold rates steady, reaching a new ATH of $3057/oz. After that, the metal proceeded to cool down a bit, showing the first red daily candle in a week. As a result, gold’s price slid to $2999/oz, completing our retracement scenario we told you about. It bounced back up soon after, awaiting new triggers to decide whether to continue the correction towards $2975/oz or resume the rally.

This week, geopolitics might be the main catalyst for the metal, with Israel’s action likely to provide further bullish momentum, while Russia-US peace talks results are to be released today at 10:00 MT Time. For this reason, our near-term outlook remains the same: below $3000/oz lies the path to $2975/oz, while any breakout above $3040/oz will likely bring back the bulls at the helm. You can use any dip below $3000/oz to add to your long position. The dominating scenario remains bullish.

Bitcoin

Bitcoin's bearish momentum stopped in the first half of last week after the release of inflation data and the Fed decision brought more hopes of easing to the markets. Moreover, Trump’s speech at yet another crypto conference, while adding nothing new to already broadly known fundamentals, seems to have reignited the strengths of the buyers. Bitcoin traded at $87000 on Monday, March 24.

As a result, BTCUSD is now following an upwardly inclined channel, depicting a strong technical trend. You can trade the crypto pair short from the upper edge, long from the lower edge, and use breakouts as turning points in Bitcoin’s newfound rise. If the channel is broken to the upside, further bullish momentum might be expected.

EURUSD

Last week, the Fiber broke down of the upward channel we showed you, preceding lower and taking a breather in a local consolidation after not even the ECB rate cut managed to stop the rally. While fundamentals aren’t too bearish for the pair right now, traders are optimistically betting long on the Union’s plans to detach military and economic needs from the US. The HCOB Manufacturing PMI also showed stronger-than-expected growth (48.3 vs forecast 47 and last 46.5), reflecting this newfound optimism.

In the long term, however, we at Headway are still skeptical about the European Union’s economic and military potential, especially if tensions with Russia do not stop. A confirmation of that stands in the proposed “Savings and Investment Union” – a European Commission’s initiative to basically dispose of private savings freely, to fuel the rearmament. If the Union has to take from the private citizens, maybe the economy is not feeling so well after all. Technicals now speak of a retracement to the downside, but many factors are at stake – the Russia-US peace talk dynamics first among them. For now, you can look for short positions, targeting 1.06600, which stands at the Fibonacci Golden Zone.Publication date:

2025-03-26 10:26:03 (GMT)