Strong bullish fundamentals have become even stronger: the Putin-Trump talks didn’t conclude much concrete for a peace deal, Israel broke the ceasefire, reigniting the war in Gaza, the US bombarded Yemen and the US economic data leave traders less and less hopes of avoiding a recession.

Today is the Fed interest rate decision day. While the rate has more chances of remaining still, particular attention should be given to Powell’s words at the FOMC Market Talk (20:30 MT Time).

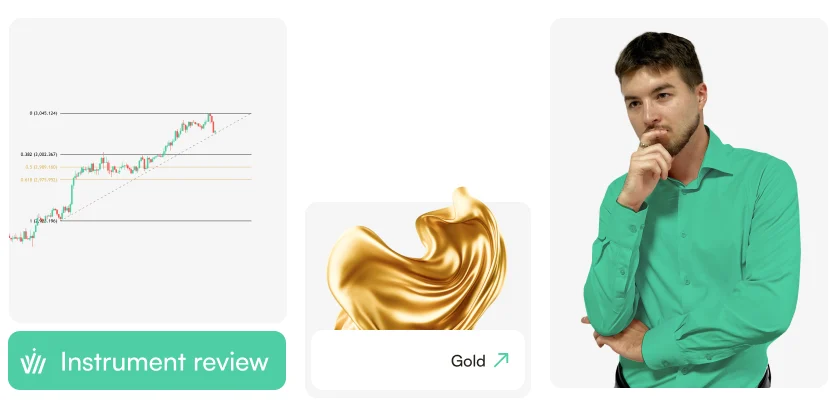

XAUUSD, 1H, March 19 11:20 MT Time

The targets of an incoming small retracement stand at $2990/oz - 2975/oz, which is the Fibonacci Golden Zone, if the Fed remains hawkish. Conversely, if the Fed presents a dovish overview, citing recent stock market and economic data weakness, on news manipulation gold has all the chances of retesting the $3000/oz mark from the upside, before continuing bullish once again.

Following the second case we would remain bullish on the leading precious metal. If tensions fail to ease in the near term and the economic data does not improve, it is only a matter of time for gold to reach new highs.

Consequently, our new targets for gold are $3100/oz, $3200/oz and finally, the $3400/oz by the end of the year, which would complete the 2025 Recession scenario.

Strong bullish fundamentals have become even stronger: the Putin-Trump talks didn’t conclude much concrete for a peace deal, Israel broke the ceasefire, reigniting the war in Gaza, the US bombarded Yemen and the US economic data leave traders less and less hopes of avoiding a recession.

Today is the Fed interest rate decision day. While the rate has more chances of remaining still, particular attention should be given to Powell’s words at the FOMC Market Talk (20:30 MT Time).

XAUUSD, 1H, March 19 11:20 MT Time

The targets of an incoming small retracement stand at $2990/oz - 2975/oz, which is the Fibonacci Golden Zone, if the Fed remains hawkish. Conversely, if the Fed presents a dovish overview, citing recent stock market and economic data weakness, on news manipulation gold has all the chances of retesting the $3000/oz mark from the upside, before continuing bullish once again.

Following the second case we would remain bullish on the leading precious metal. If tensions fail to ease in the near term and the economic data does not improve, it is only a matter of time for gold to reach new highs.

Consequently, our new targets for gold are $3100/oz, $3200/oz and finally, the $3400/oz by the end of the year, which would complete the 2025 Recession scenario.Old XAUUSD Targets Reached, New Targets Inbound

Strong bullish fundamentals have become even stronger: the Putin-Trump talks didn’t conclude much concrete for a peace deal, Israel broke the ceasefire, reigniting the war in Gaza, the US bombarded Yemen and the US economic data leave traders less and less hopes of avoiding a recession.

Today is the Fed interest rate decision day. While the rate has more chances of remaining still, particular attention should be given to Powell’s words at the FOMC Market Talk (20:30 MT Time).

XAUUSD, 1H, March 19 11:20 MT Time

The targets of an incoming small retracement stand at $2990/oz - 2975/oz, which is the Fibonacci Golden Zone, if the Fed remains hawkish. Conversely, if the Fed presents a dovish overview, citing recent stock market and economic data weakness, on news manipulation gold has all the chances of retesting the $3000/oz mark from the upside, before continuing bullish once again.

Following the second case we would remain bullish on the leading precious metal. If tensions fail to ease in the near term and the economic data does not improve, it is only a matter of time for gold to reach new highs.

Consequently, our new targets for gold are $3100/oz, $3200/oz and finally, the $3400/oz by the end of the year, which would complete the 2025 Recession scenario.

Strong bullish fundamentals have become even stronger: the Putin-Trump talks didn’t conclude much concrete for a peace deal, Israel broke the ceasefire, reigniting the war in Gaza, the US bombarded Yemen and the US economic data leave traders less and less hopes of avoiding a recession.

Today is the Fed interest rate decision day. While the rate has more chances of remaining still, particular attention should be given to Powell’s words at the FOMC Market Talk (20:30 MT Time).

XAUUSD, 1H, March 19 11:20 MT Time

The targets of an incoming small retracement stand at $2990/oz - 2975/oz, which is the Fibonacci Golden Zone, if the Fed remains hawkish. Conversely, if the Fed presents a dovish overview, citing recent stock market and economic data weakness, on news manipulation gold has all the chances of retesting the $3000/oz mark from the upside, before continuing bullish once again.

Following the second case we would remain bullish on the leading precious metal. If tensions fail to ease in the near term and the economic data does not improve, it is only a matter of time for gold to reach new highs.

Consequently, our new targets for gold are $3100/oz, $3200/oz and finally, the $3400/oz by the end of the year, which would complete the 2025 Recession scenario.Publication date:

2025-03-19 11:22:37 (GMT)