The sharp drop appears to be fueled by a mix of concerns over President Prabowo Subianto's populist policies, power concentration in his own hands, forced liquidations, and uncertainty surrounding the future of Indonesia’s Finance Ministry. The President’s move to redirect state funds into his own priority projects, including placing seven state-owned enterprises under the newly formed sovereign wealth fund Danantara, has further unsettled markets. Foreign investors, already uneasy about budget reallocations and weakening government revenues, accelerated their exodus, dumping $1.6 billions of worth of Indonesian stocks.

A 30-minute trading halt was triggered after the index tumbled more than 5%, marking the first such suspension since 2020. Market confidence was further rattled by speculation that Finance Minister Sri Mulyani Indrawati – highly respected for her economic stewardship – was considering resignation (a rumor she has by now declined).

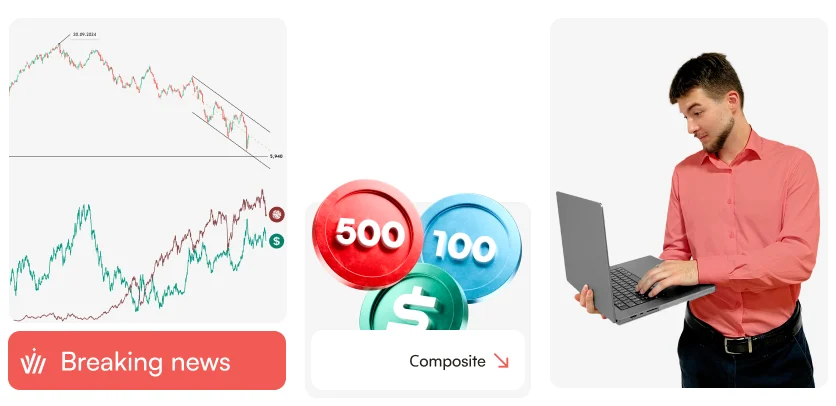

On the chart, this dynamic can be clearly seen after the ATH touched by the Jakarta Composite on September 20, 2024. Prabowo’s inauguration happened on October 20, which coincided with the first lower-high of the previous bull market. Since then, it has been a bearish bloodbath, with the COMPOSITE crashing 22.5%, wiping out all the previous year’s gains.

As global investors flee, the pressure is on policymakers to restore confidence and signal a clear economic direction. Today’s Fed interest rate decision might be crucial to determine the near future of the Indonesian market. Historically, the strength of the USD has an inverse correlation with the COMPOSITE, as lower rates in the States increase global investor’s appetite for foreign assets in developing economies.

If the Fed’s tone will change towards a more dovish stance, inviting rate cuts, the COMPOSITE might rise. Conversely, a steep fall might be expected, if the rates are held steady and the tone remains hawkish.

Now you can open short positions around the upper edge of the descending channel (around 6,500 points), targeting the 2018-2021 key resistance level at 5,940 points. The upper edge should be reached if the first Fed dovish scenario will be the one to happen, providing an interesting entry point into the Indonesian bearish market.

Without reassurance from the government, Indonesia risks deeper capital outflows and further market turmoil.

The sharp drop appears to be fueled by a mix of concerns over President Prabowo Subianto's populist policies, power concentration in his own hands, forced liquidations, and uncertainty surrounding the future of Indonesia’s Finance Ministry. The President’s move to redirect state funds into his own priority projects, including placing seven state-owned enterprises under the newly formed sovereign wealth fund Danantara, has further unsettled markets. Foreign investors, already uneasy about budget reallocations and weakening government revenues, accelerated their exodus, dumping $1.6 billions of worth of Indonesian stocks.

A 30-minute trading halt was triggered after the index tumbled more than 5%, marking the first such suspension since 2020. Market confidence was further rattled by speculation that Finance Minister Sri Mulyani Indrawati – highly respected for her economic stewardship – was considering resignation (a rumor she has by now declined).

On the chart, this dynamic can be clearly seen after the ATH touched by the Jakarta Composite on September 20, 2024. Prabowo’s inauguration happened on October 20, which coincided with the first lower-high of the previous bull market. Since then, it has been a bearish bloodbath, with the COMPOSITE crashing 22.5%, wiping out all the previous year’s gains.

As global investors flee, the pressure is on policymakers to restore confidence and signal a clear economic direction. Today’s Fed interest rate decision might be crucial to determine the near future of the Indonesian market. Historically, the strength of the USD has an inverse correlation with the COMPOSITE, as lower rates in the States increase global investor’s appetite for foreign assets in developing economies.

If the Fed’s tone will change towards a more dovish stance, inviting rate cuts, the COMPOSITE might rise. Conversely, a steep fall might be expected, if the rates are held steady and the tone remains hawkish.

Now you can open short positions around the upper edge of the descending channel (around 6,500 points), targeting the 2018-2021 key resistance level at 5,940 points. The upper edge should be reached if the first Fed dovish scenario will be the one to happen, providing an interesting entry point into the Indonesian bearish market.

Without reassurance from the government, Indonesia risks deeper capital outflows and further market turmoil.Jakarta Composite Index Plunges on Fiscal Strategy Fears

The sharp drop appears to be fueled by a mix of concerns over President Prabowo Subianto's populist policies, power concentration in his own hands, forced liquidations, and uncertainty surrounding the future of Indonesia’s Finance Ministry. The President’s move to redirect state funds into his own priority projects, including placing seven state-owned enterprises under the newly formed sovereign wealth fund Danantara, has further unsettled markets. Foreign investors, already uneasy about budget reallocations and weakening government revenues, accelerated their exodus, dumping $1.6 billions of worth of Indonesian stocks.

A 30-minute trading halt was triggered after the index tumbled more than 5%, marking the first such suspension since 2020. Market confidence was further rattled by speculation that Finance Minister Sri Mulyani Indrawati – highly respected for her economic stewardship – was considering resignation (a rumor she has by now declined).

On the chart, this dynamic can be clearly seen after the ATH touched by the Jakarta Composite on September 20, 2024. Prabowo’s inauguration happened on October 20, which coincided with the first lower-high of the previous bull market. Since then, it has been a bearish bloodbath, with the COMPOSITE crashing 22.5%, wiping out all the previous year’s gains.

As global investors flee, the pressure is on policymakers to restore confidence and signal a clear economic direction. Today’s Fed interest rate decision might be crucial to determine the near future of the Indonesian market. Historically, the strength of the USD has an inverse correlation with the COMPOSITE, as lower rates in the States increase global investor’s appetite for foreign assets in developing economies.

If the Fed’s tone will change towards a more dovish stance, inviting rate cuts, the COMPOSITE might rise. Conversely, a steep fall might be expected, if the rates are held steady and the tone remains hawkish.

Now you can open short positions around the upper edge of the descending channel (around 6,500 points), targeting the 2018-2021 key resistance level at 5,940 points. The upper edge should be reached if the first Fed dovish scenario will be the one to happen, providing an interesting entry point into the Indonesian bearish market.

Without reassurance from the government, Indonesia risks deeper capital outflows and further market turmoil.

The sharp drop appears to be fueled by a mix of concerns over President Prabowo Subianto's populist policies, power concentration in his own hands, forced liquidations, and uncertainty surrounding the future of Indonesia’s Finance Ministry. The President’s move to redirect state funds into his own priority projects, including placing seven state-owned enterprises under the newly formed sovereign wealth fund Danantara, has further unsettled markets. Foreign investors, already uneasy about budget reallocations and weakening government revenues, accelerated their exodus, dumping $1.6 billions of worth of Indonesian stocks.

A 30-minute trading halt was triggered after the index tumbled more than 5%, marking the first such suspension since 2020. Market confidence was further rattled by speculation that Finance Minister Sri Mulyani Indrawati – highly respected for her economic stewardship – was considering resignation (a rumor she has by now declined).

On the chart, this dynamic can be clearly seen after the ATH touched by the Jakarta Composite on September 20, 2024. Prabowo’s inauguration happened on October 20, which coincided with the first lower-high of the previous bull market. Since then, it has been a bearish bloodbath, with the COMPOSITE crashing 22.5%, wiping out all the previous year’s gains.

As global investors flee, the pressure is on policymakers to restore confidence and signal a clear economic direction. Today’s Fed interest rate decision might be crucial to determine the near future of the Indonesian market. Historically, the strength of the USD has an inverse correlation with the COMPOSITE, as lower rates in the States increase global investor’s appetite for foreign assets in developing economies.

If the Fed’s tone will change towards a more dovish stance, inviting rate cuts, the COMPOSITE might rise. Conversely, a steep fall might be expected, if the rates are held steady and the tone remains hawkish.

Now you can open short positions around the upper edge of the descending channel (around 6,500 points), targeting the 2018-2021 key resistance level at 5,940 points. The upper edge should be reached if the first Fed dovish scenario will be the one to happen, providing an interesting entry point into the Indonesian bearish market.

Without reassurance from the government, Indonesia risks deeper capital outflows and further market turmoil.Publication date:

2025-03-19 11:22:24 (GMT)