Tesla (#TSLA) crashed an astonishing -28.5% since our outlook update on February 27. Nvidia (#NVDA) is also in reach of the first target of $100/share. If you traded short, following our recommendations – congratulations!

As everything was falling, the VIX fear index surged to levels unsees since August 2024, when the publication of worse-than-expected NFP data. US high-yield corporate bond spreads widened, signaling rising credit stress, while Treasury yields fell and the USD hit new yearly lows.

Yesterday, March 11, after positive news arrived from the US–Ukraine peace talks, the market rebound some ticks, only to fall down again after short-lived positivity was digested.

Today important US inflation data is due. If it fails to impress investors with a steep decline, odds are that with the Fed holding rates steady, recession fears will mount. A heavier correction, perhaps even a market crash can happen.

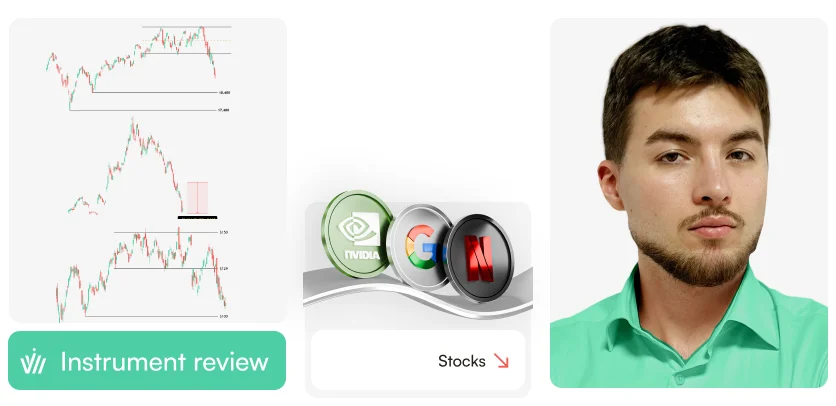

As hedge-funds deleveraged and sold billions in stocks, only to later secure short positions, our outlook on US stocks remains bearish. A technical upside correction is possible, as the market remains heavily oversold, but ultimately, if the Fed remains hawkish, the market can be expected far lower (even going to the 18,400 - 17,400 points range on the Nasdaq).

Tesla (#TSLA) crashed an astonishing -28.5% since our outlook update on February 27. Nvidia (#NVDA) is also in reach of the first target of $100/share. If you traded short, following our recommendations – congratulations!

As everything was falling, the VIX fear index surged to levels unsees since August 2024, when the publication of worse-than-expected NFP data. US high-yield corporate bond spreads widened, signaling rising credit stress, while Treasury yields fell and the USD hit new yearly lows.

Yesterday, March 11, after positive news arrived from the US–Ukraine peace talks, the market rebound some ticks, only to fall down again after short-lived positivity was digested.

Today important US inflation data is due. If it fails to impress investors with a steep decline, odds are that with the Fed holding rates steady, recession fears will mount. A heavier correction, perhaps even a market crash can happen.

As hedge-funds deleveraged and sold billions in stocks, only to later secure short positions, our outlook on US stocks remains bearish. A technical upside correction is possible, as the market remains heavily oversold, but ultimately, if the Fed remains hawkish, the market can be expected far lower (even going to the 18,400 - 17,400 points range on the Nasdaq).Wall Street Rout Wipes $4 Trillion in Market Capitalization. What’s Next?

Tesla (#TSLA) crashed an astonishing -28.5% since our outlook update on February 27. Nvidia (#NVDA) is also in reach of the first target of $100/share. If you traded short, following our recommendations – congratulations!

As everything was falling, the VIX fear index surged to levels unsees since August 2024, when the publication of worse-than-expected NFP data. US high-yield corporate bond spreads widened, signaling rising credit stress, while Treasury yields fell and the USD hit new yearly lows.

Yesterday, March 11, after positive news arrived from the US–Ukraine peace talks, the market rebound some ticks, only to fall down again after short-lived positivity was digested.

Today important US inflation data is due. If it fails to impress investors with a steep decline, odds are that with the Fed holding rates steady, recession fears will mount. A heavier correction, perhaps even a market crash can happen.

As hedge-funds deleveraged and sold billions in stocks, only to later secure short positions, our outlook on US stocks remains bearish. A technical upside correction is possible, as the market remains heavily oversold, but ultimately, if the Fed remains hawkish, the market can be expected far lower (even going to the 18,400 - 17,400 points range on the Nasdaq).

Tesla (#TSLA) crashed an astonishing -28.5% since our outlook update on February 27. Nvidia (#NVDA) is also in reach of the first target of $100/share. If you traded short, following our recommendations – congratulations!

As everything was falling, the VIX fear index surged to levels unsees since August 2024, when the publication of worse-than-expected NFP data. US high-yield corporate bond spreads widened, signaling rising credit stress, while Treasury yields fell and the USD hit new yearly lows.

Yesterday, March 11, after positive news arrived from the US–Ukraine peace talks, the market rebound some ticks, only to fall down again after short-lived positivity was digested.

Today important US inflation data is due. If it fails to impress investors with a steep decline, odds are that with the Fed holding rates steady, recession fears will mount. A heavier correction, perhaps even a market crash can happen.

As hedge-funds deleveraged and sold billions in stocks, only to later secure short positions, our outlook on US stocks remains bearish. A technical upside correction is possible, as the market remains heavily oversold, but ultimately, if the Fed remains hawkish, the market can be expected far lower (even going to the 18,400 - 17,400 points range on the Nasdaq).Publication date:

2025-03-12 08:24:42 (GMT)