Market Weekly Overview | March 11

Key market news and statistics:

-Trump threatens new tariffs on Russian banks if peace is not achieved quickly

-China launches “Manus”, an AI agent capable of independent thought

-Renewed fighting breaks out in Syria between new government and Alawites

-Israel breaks Gaza ceasfire, 2 civilians killed in drone strike

-March 7 NFP data hints at economic growth slowing down

-Crypto conference disappoints investors, leads to crypto sell-off

-US inflation rate due on Wednesday, March 12, 14:30 MT Time

Gold

Key market news and statistics:

-Trump threatens new tariffs on Russian banks if peace is not achieved quickly

-China launches “Manus”, an AI agent capable of independent thought

-Renewed fighting breaks out in Syria between new government and Alawites

-Israel breaks Gaza ceasfire, 2 civilians killed in drone strike

-March 7 NFP data hints at economic growth slowing down

-Crypto conference disappoints investors, leads to crypto sell-off

-US inflation rate due on Wednesday, March 12, 14:30 MT Time

Gold

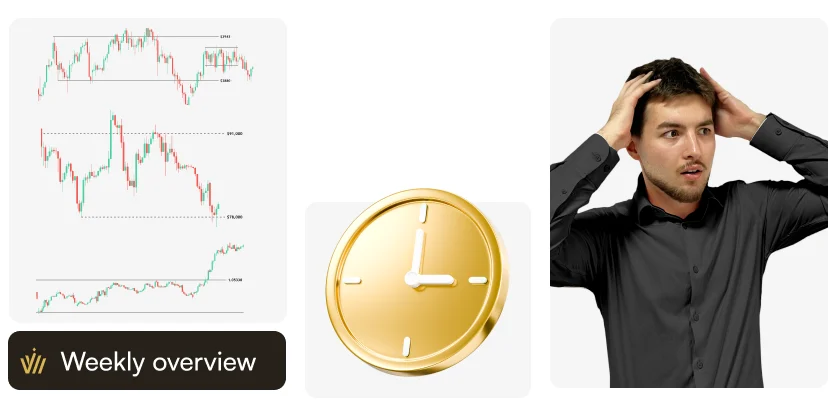

Gold returned inside the bigger consolidation range, marked by $2880/oz – $2943/oz, forming another smaller consolidation between the $2927/oz – $2900/oz. Long term fundamentals, which still point at upside momentum, have been reinforced last Friday on weaker NFP data and a rising US unemployment rate. Prolonged peace talks in Ukraine and the risk of a civil war in Syria add on the political bullish front.

Once again we advise you to wait before taking any medium-term action. A break and close above $2943/oz. will be the signal you were waiting for to follow the metal up to the $3000/oz target. Any dip below $2880/oz can be used to buy into a new long position, if you already do not have one. High chances are that incoming US inflation data will play the key role this week, with slowing price growth likely leading to a surge in non-interest bearing bullion.

Bitcoin

The whole of crypto crashed again, after regaining ground on the announcement of an official US crypto reserve. Investors expected the US administration to buy into Bitcoin at market price, while the proposed mechanism to accumulate these reserves will rely more on confiscations and other non-market measures. The big crypto-conference on March 7 failed to provide new valuable insights into future plans.

Now, a dip below $78,000 will likely lead to further downside, while a return and consolidation above $91,000 can become the catalyst for renewed bullish momentum. While long term drivers continue to look bullish, the developments of last week pose a strong bearish threat to the leading cryptocurrency.

EURUSD

As per our analysis last week, EURUSD surged above the 1.05330 level, which led to a strong bullish impulse. Major drivers of the move were Germany’s newly elected government revision of “debt caps”, to boost debt contraction to aid the country’s crumbling industrial sector and a rally in defense stocks all across Europe. Also, the ECB delivered a rate cut, which failed to cool down the upward momentum, leading only to a local consolidation.

Now, the short-term outlook is bullish for the Fiber. You can use a trend following strategy and open long positions, at least until the US CPI data is released on March 12. If the data hints at a slower pace of price increases, the case for a Fed rate cut can send EURUSD even higher.

Gold returned inside the bigger consolidation range, marked by $2880/oz – $2943/oz, forming another smaller consolidation between the $2927/oz – $2900/oz. Long term fundamentals, which still point at upside momentum, have been reinforced last Friday on weaker NFP data and a rising US unemployment rate. Prolonged peace talks in Ukraine and the risk of a civil war in Syria add on the political bullish front.

Once again we advise you to wait before taking any medium-term action. A break and close above $2943/oz. will be the signal you were waiting for to follow the metal up to the $3000/oz target. Any dip below $2880/oz can be used to buy into a new long position, if you already do not have one. High chances are that incoming US inflation data will play the key role this week, with slowing price growth likely leading to a surge in non-interest bearing bullion.

Bitcoin

The whole of crypto crashed again, after regaining ground on the announcement of an official US crypto reserve. Investors expected the US administration to buy into Bitcoin at market price, while the proposed mechanism to accumulate these reserves will rely more on confiscations and other non-market measures. The big crypto-conference on March 7 failed to provide new valuable insights into future plans.

Now, a dip below $78,000 will likely lead to further downside, while a return and consolidation above $91,000 can become the catalyst for renewed bullish momentum. While long term drivers continue to look bullish, the developments of last week pose a strong bearish threat to the leading cryptocurrency.

EURUSD

As per our analysis last week, EURUSD surged above the 1.05330 level, which led to a strong bullish impulse. Major drivers of the move were Germany’s newly elected government revision of “debt caps”, to boost debt contraction to aid the country’s crumbling industrial sector and a rally in defense stocks all across Europe. Also, the ECB delivered a rate cut, which failed to cool down the upward momentum, leading only to a local consolidation.

Now, the short-term outlook is bullish for the Fiber. You can use a trend following strategy and open long positions, at least until the US CPI data is released on March 12. If the data hints at a slower pace of price increases, the case for a Fed rate cut can send EURUSD even higher.Publication date:

2025-03-11 08:47:06 (GMT)

Key market news and statistics:

-Trump threatens new tariffs on Russian banks if peace is not achieved quickly

-China launches “Manus”, an AI agent capable of independent thought

-Renewed fighting breaks out in Syria between new government and Alawites

-Israel breaks Gaza ceasfire, 2 civilians killed in drone strike

-March 7 NFP data hints at economic growth slowing down

-Crypto conference disappoints investors, leads to crypto sell-off

-US inflation rate due on Wednesday, March 12, 14:30 MT Time

Gold

Key market news and statistics:

-Trump threatens new tariffs on Russian banks if peace is not achieved quickly

-China launches “Manus”, an AI agent capable of independent thought

-Renewed fighting breaks out in Syria between new government and Alawites

-Israel breaks Gaza ceasfire, 2 civilians killed in drone strike

-March 7 NFP data hints at economic growth slowing down

-Crypto conference disappoints investors, leads to crypto sell-off

-US inflation rate due on Wednesday, March 12, 14:30 MT Time

Gold

Gold returned inside the bigger consolidation range, marked by $2880/oz – $2943/oz, forming another smaller consolidation between the $2927/oz – $2900/oz. Long term fundamentals, which still point at upside momentum, have been reinforced last Friday on weaker NFP data and a rising US unemployment rate. Prolonged peace talks in Ukraine and the risk of a civil war in Syria add on the political bullish front.

Once again we advise you to wait before taking any medium-term action. A break and close above $2943/oz. will be the signal you were waiting for to follow the metal up to the $3000/oz target. Any dip below $2880/oz can be used to buy into a new long position, if you already do not have one. High chances are that incoming US inflation data will play the key role this week, with slowing price growth likely leading to a surge in non-interest bearing bullion.

Bitcoin

The whole of crypto crashed again, after regaining ground on the announcement of an official US crypto reserve. Investors expected the US administration to buy into Bitcoin at market price, while the proposed mechanism to accumulate these reserves will rely more on confiscations and other non-market measures. The big crypto-conference on March 7 failed to provide new valuable insights into future plans.

Now, a dip below $78,000 will likely lead to further downside, while a return and consolidation above $91,000 can become the catalyst for renewed bullish momentum. While long term drivers continue to look bullish, the developments of last week pose a strong bearish threat to the leading cryptocurrency.

EURUSD

As per our analysis last week, EURUSD surged above the 1.05330 level, which led to a strong bullish impulse. Major drivers of the move were Germany’s newly elected government revision of “debt caps”, to boost debt contraction to aid the country’s crumbling industrial sector and a rally in defense stocks all across Europe. Also, the ECB delivered a rate cut, which failed to cool down the upward momentum, leading only to a local consolidation.

Now, the short-term outlook is bullish for the Fiber. You can use a trend following strategy and open long positions, at least until the US CPI data is released on March 12. If the data hints at a slower pace of price increases, the case for a Fed rate cut can send EURUSD even higher.

Gold returned inside the bigger consolidation range, marked by $2880/oz – $2943/oz, forming another smaller consolidation between the $2927/oz – $2900/oz. Long term fundamentals, which still point at upside momentum, have been reinforced last Friday on weaker NFP data and a rising US unemployment rate. Prolonged peace talks in Ukraine and the risk of a civil war in Syria add on the political bullish front.

Once again we advise you to wait before taking any medium-term action. A break and close above $2943/oz. will be the signal you were waiting for to follow the metal up to the $3000/oz target. Any dip below $2880/oz can be used to buy into a new long position, if you already do not have one. High chances are that incoming US inflation data will play the key role this week, with slowing price growth likely leading to a surge in non-interest bearing bullion.

Bitcoin

The whole of crypto crashed again, after regaining ground on the announcement of an official US crypto reserve. Investors expected the US administration to buy into Bitcoin at market price, while the proposed mechanism to accumulate these reserves will rely more on confiscations and other non-market measures. The big crypto-conference on March 7 failed to provide new valuable insights into future plans.

Now, a dip below $78,000 will likely lead to further downside, while a return and consolidation above $91,000 can become the catalyst for renewed bullish momentum. While long term drivers continue to look bullish, the developments of last week pose a strong bearish threat to the leading cryptocurrency.

EURUSD

As per our analysis last week, EURUSD surged above the 1.05330 level, which led to a strong bullish impulse. Major drivers of the move were Germany’s newly elected government revision of “debt caps”, to boost debt contraction to aid the country’s crumbling industrial sector and a rally in defense stocks all across Europe. Also, the ECB delivered a rate cut, which failed to cool down the upward momentum, leading only to a local consolidation.

Now, the short-term outlook is bullish for the Fiber. You can use a trend following strategy and open long positions, at least until the US CPI data is released on March 12. If the data hints at a slower pace of price increases, the case for a Fed rate cut can send EURUSD even higher.