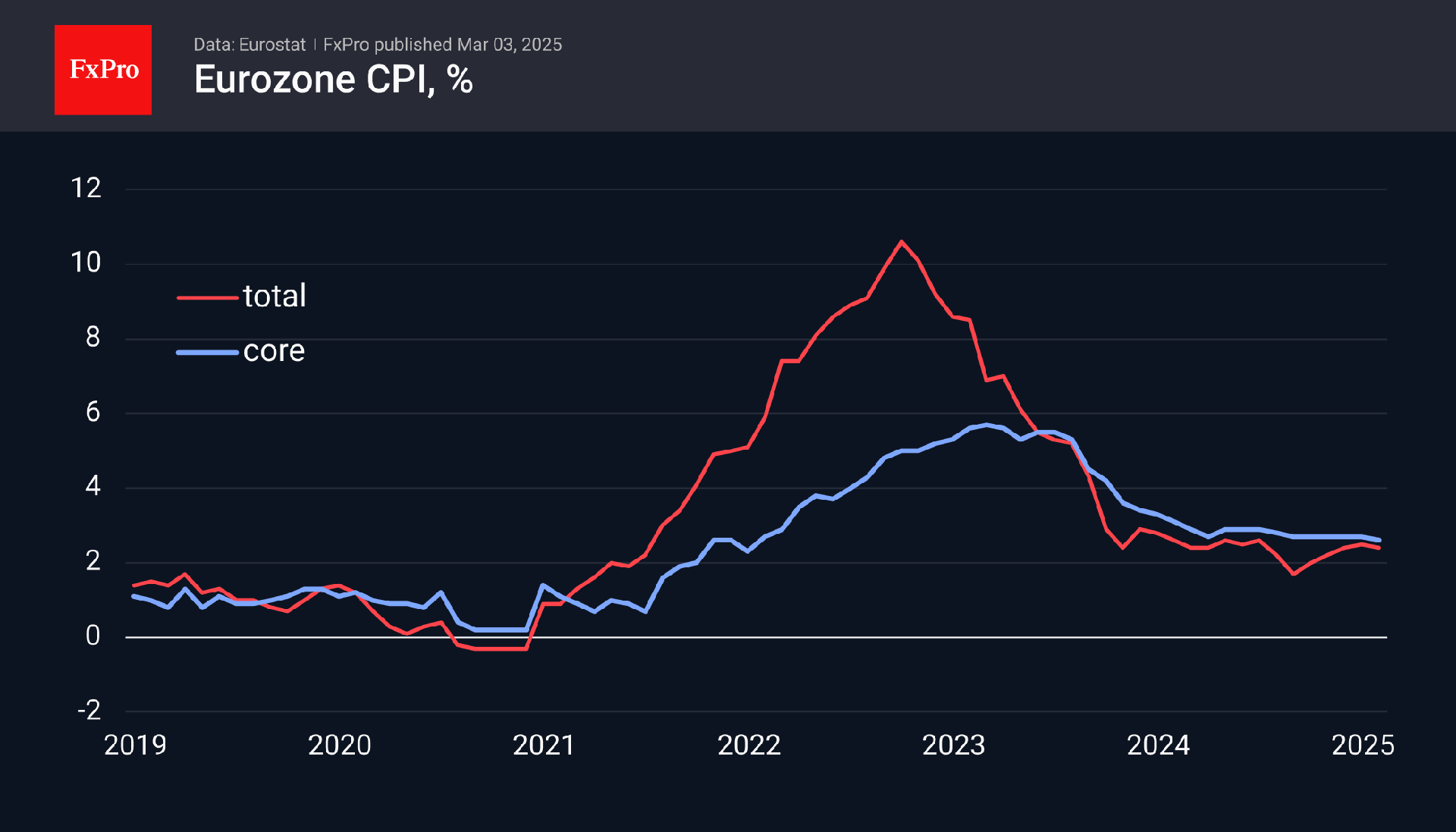

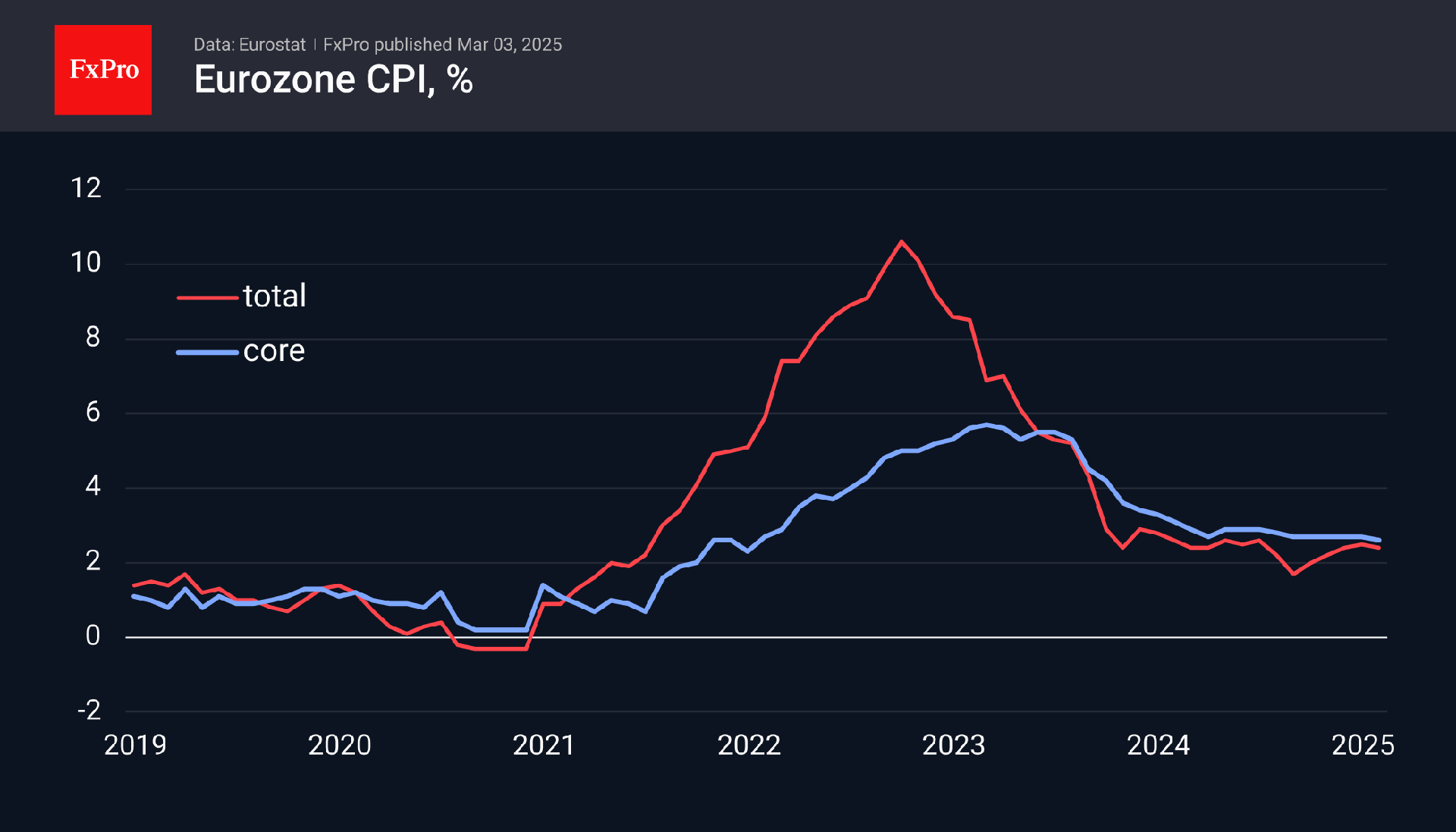

The headline CPI declined to 2.4%, down from a peak of 2.5%, yet remains well above September’s 1.7% year-on-year rate. Over the past 17 months, inflation has held steady at around 2.4%, surpassing the target of “around 1.8%”.

Meanwhile, the core price index, excluding volatile goods, has dipped to 2.6%, marking its lowest level since early 2022 but still significantly higher than the stable inflation observed until mid-2021.

Despite these figures, the ECB has already slashed its key rate by 160 basis points since last September. Following today’s report, another quarter-point cut is expected on Thursday, which mitigates the risk of sudden inflation spikes.

Earlier in the week, the euro strengthened due to robust inflation data and improved European PMI readings for late February. For the ECB, stabilising and potential appreciation of the euro could influence further easing measures. With weak domestic demand in Europe posing minimal inflationary threats, the economy has responded positively to monetary easing and euro depreciation observed since late 2024.

The headline CPI declined to 2.4%, down from a peak of 2.5%, yet remains well above September’s 1.7% year-on-year rate. Over the past 17 months, inflation has held steady at around 2.4%, surpassing the target of “around 1.8%”.

Meanwhile, the core price index, excluding volatile goods, has dipped to 2.6%, marking its lowest level since early 2022 but still significantly higher than the stable inflation observed until mid-2021.

Despite these figures, the ECB has already slashed its key rate by 160 basis points since last September. Following today’s report, another quarter-point cut is expected on Thursday, which mitigates the risk of sudden inflation spikes.

Earlier in the week, the euro strengthened due to robust inflation data and improved European PMI readings for late February. For the ECB, stabilising and potential appreciation of the euro could influence further easing measures. With weak domestic demand in Europe posing minimal inflationary threats, the economy has responded positively to monetary easing and euro depreciation observed since late 2024.Eurozone inflation will not prevent ECB easing

The headline CPI declined to 2.4%, down from a peak of 2.5%, yet remains well above September’s 1.7% year-on-year rate. Over the past 17 months, inflation has held steady at around 2.4%, surpassing the target of “around 1.8%”.

Meanwhile, the core price index, excluding volatile goods, has dipped to 2.6%, marking its lowest level since early 2022 but still significantly higher than the stable inflation observed until mid-2021.

Despite these figures, the ECB has already slashed its key rate by 160 basis points since last September. Following today’s report, another quarter-point cut is expected on Thursday, which mitigates the risk of sudden inflation spikes.

Earlier in the week, the euro strengthened due to robust inflation data and improved European PMI readings for late February. For the ECB, stabilising and potential appreciation of the euro could influence further easing measures. With weak domestic demand in Europe posing minimal inflationary threats, the economy has responded positively to monetary easing and euro depreciation observed since late 2024.

The headline CPI declined to 2.4%, down from a peak of 2.5%, yet remains well above September’s 1.7% year-on-year rate. Over the past 17 months, inflation has held steady at around 2.4%, surpassing the target of “around 1.8%”.

Meanwhile, the core price index, excluding volatile goods, has dipped to 2.6%, marking its lowest level since early 2022 but still significantly higher than the stable inflation observed until mid-2021.

Despite these figures, the ECB has already slashed its key rate by 160 basis points since last September. Following today’s report, another quarter-point cut is expected on Thursday, which mitigates the risk of sudden inflation spikes.

Earlier in the week, the euro strengthened due to robust inflation data and improved European PMI readings for late February. For the ECB, stabilising and potential appreciation of the euro could influence further easing measures. With weak domestic demand in Europe posing minimal inflationary threats, the economy has responded positively to monetary easing and euro depreciation observed since late 2024.Publication date:

2025-03-03 14:00:04 (GMT)