RBA kept rate unchanged but failed to stop the AUD slide

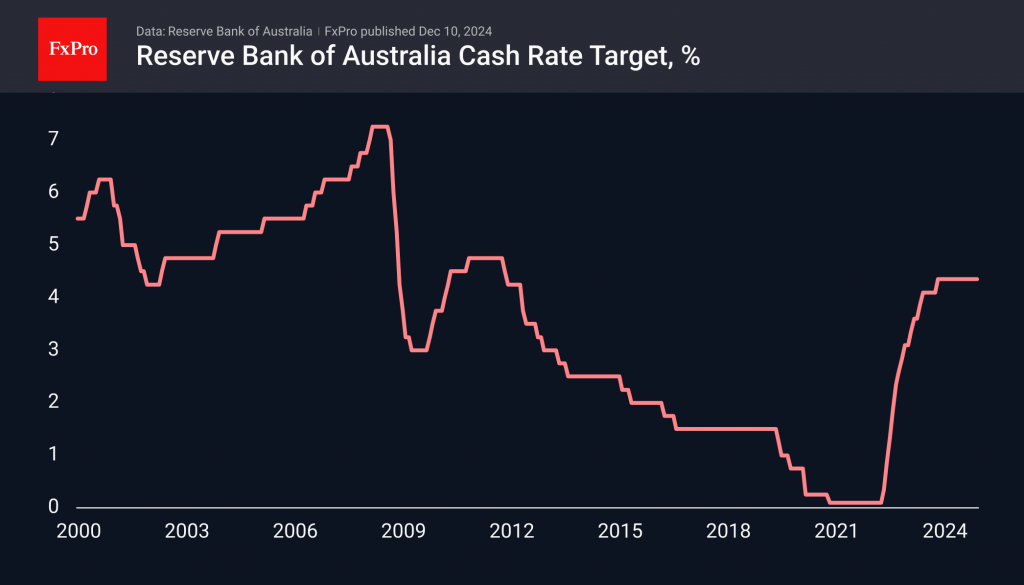

The Reserve Bank of Australia kept its cash rate unchanged at 4.35%, maintaining it at a 13-year high for the past 13 months.

Most of the RBA's peers have moved to ease monetary policy at various points this year, including aggressive cuts by neighbouring RBNZ, suggesting that inflation is on a downward trajectory. Australian consumer inflation was 2.1% in September and October (latest data available). However, this is not enough for the RBA, which noted that the core inflation rate of 3.5% is still above the 2.5% target.

However, the RBA has indicated growing confidence that inflation will return to target, seemingly opening the door to an easing of policy soon.

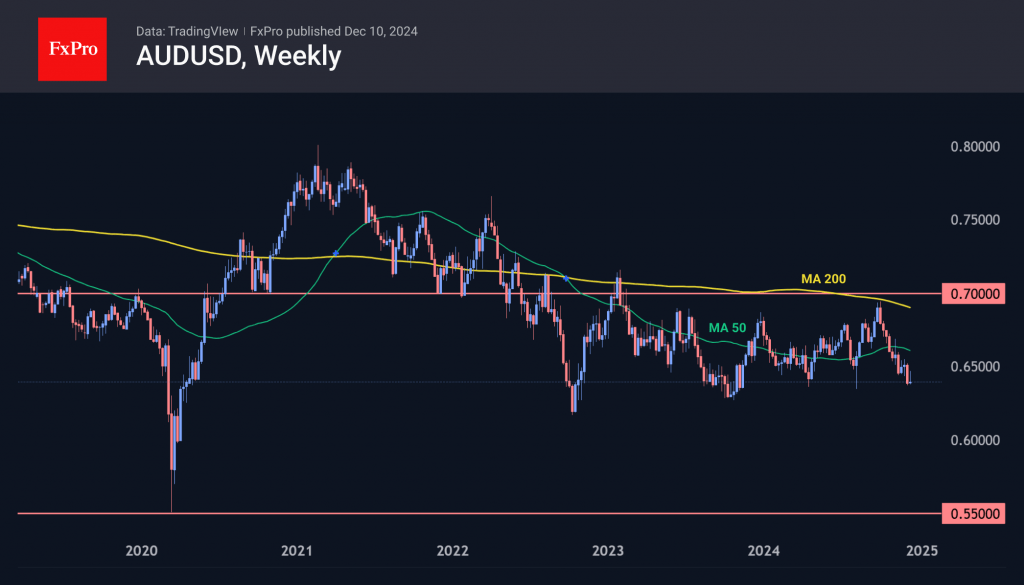

The AUDUSD, at 0.6400, is trading at the lower end of its range of the past two years, having lost around 8% over the past 10 weeks. Technically, this was a reversal to the downside from the 200-week moving average. Now, it is important to watch how the pair performs in the coming weeks. A break of the long-term support will open the way for a decline to 0.55. The ability to hold above will trigger a scenario of a return to the 0.70 area.

However, the RBA has indicated growing confidence that inflation will return to target, seemingly opening the door to an easing of policy soon.

The AUDUSD, at 0.6400, is trading at the lower end of its range of the past two years, having lost around 8% over the past 10 weeks. Technically, this was a reversal to the downside from the 200-week moving average. Now, it is important to watch how the pair performs in the coming weeks. A break of the long-term support will open the way for a decline to 0.55. The ability to hold above will trigger a scenario of a return to the 0.70 area.

[i]The FxPro Analyst Team[/i]

[i]The FxPro Analyst Team[/i] Publication date:

2024-12-10 14:20:30 (GMT)

However, the RBA has indicated growing confidence that inflation will return to target, seemingly opening the door to an easing of policy soon.

The AUDUSD, at 0.6400, is trading at the lower end of its range of the past two years, having lost around 8% over the past 10 weeks. Technically, this was a reversal to the downside from the 200-week moving average. Now, it is important to watch how the pair performs in the coming weeks. A break of the long-term support will open the way for a decline to 0.55. The ability to hold above will trigger a scenario of a return to the 0.70 area.

However, the RBA has indicated growing confidence that inflation will return to target, seemingly opening the door to an easing of policy soon.

The AUDUSD, at 0.6400, is trading at the lower end of its range of the past two years, having lost around 8% over the past 10 weeks. Technically, this was a reversal to the downside from the 200-week moving average. Now, it is important to watch how the pair performs in the coming weeks. A break of the long-term support will open the way for a decline to 0.55. The ability to hold above will trigger a scenario of a return to the 0.70 area.

[i]The FxPro Analyst Team[/i]

[i]The FxPro Analyst Team[/i]