EUR/JPY Closing in on 200-Day SMA

Technical Confluence Demands Attention

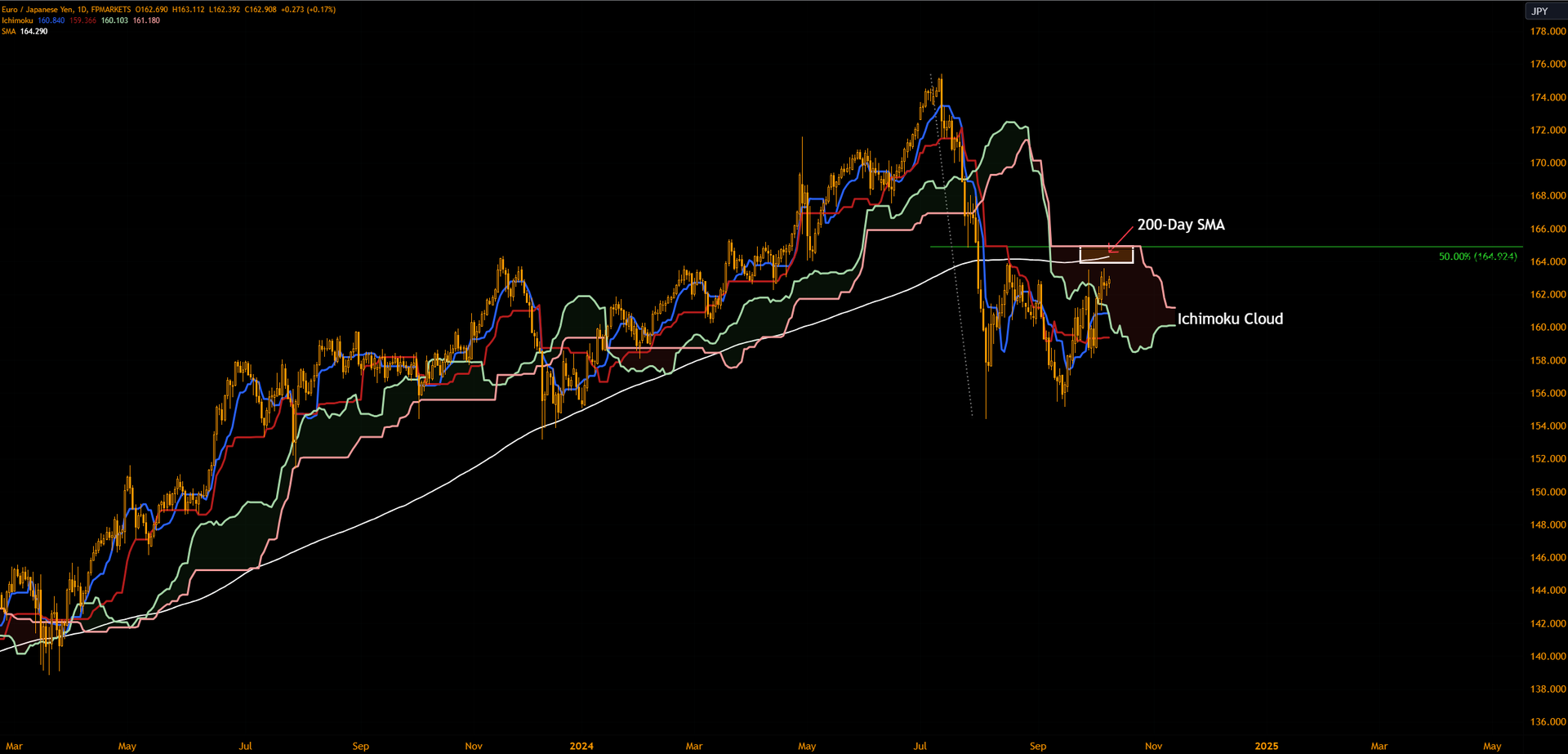

Overhead, the 200-day simple moving average (SMA – white at ¥164.29), coupled with the upper boundary of the Ichimoku Cloud, the 50.0% retracement ratio and the 100% projection ratio around ¥164.92, could be enough to tempt a more solid showing from bears.

Price Direction?

Although the technical confluence around the upper region of the Ichimoku Cloud warrants attention, the trend has been strong to the upside since early 2020 for the EUR/JPY pair. The price close below the 200-day SMA supports a bearish trend reversal, though it is likely too early to call the recent correction a trend change in this market.

This places a bold question mark on the above-noted resistance confluence. Therefore, Ichimoku traders interested in shorting the upper area of the Ichimoku Cloud may wait and see if the Conversion Line (blue at ¥160.84) crosses back under the Base Line (red at ¥159.37) before committing. Slightly more aggressive sellers could consider a bearish scenario following a price close below the Base Line.

Technical Confluence Demands Attention

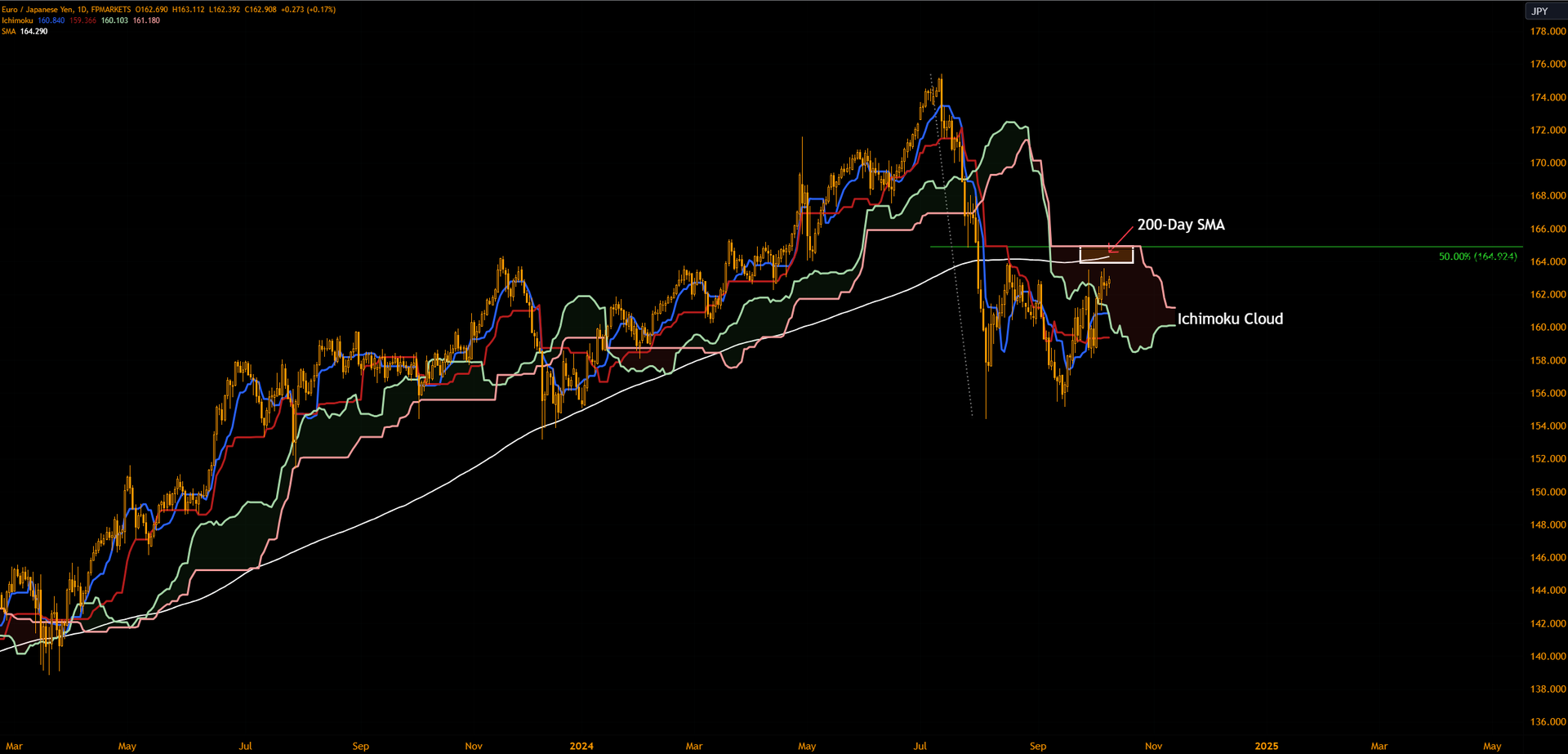

Overhead, the 200-day simple moving average (SMA – white at ¥164.29), coupled with the upper boundary of the Ichimoku Cloud, the 50.0% retracement ratio and the 100% projection ratio around ¥164.92, could be enough to tempt a more solid showing from bears.

Price Direction?

Although the technical confluence around the upper region of the Ichimoku Cloud warrants attention, the trend has been strong to the upside since early 2020 for the EUR/JPY pair. The price close below the 200-day SMA supports a bearish trend reversal, though it is likely too early to call the recent correction a trend change in this market.

This places a bold question mark on the above-noted resistance confluence. Therefore, Ichimoku traders interested in shorting the upper area of the Ichimoku Cloud may wait and see if the Conversion Line (blue at ¥160.84) crosses back under the Base Line (red at ¥159.37) before committing. Slightly more aggressive sellers could consider a bearish scenario following a price close below the Base Line.

Publication date:

2024-10-09 12:44:03 (GMT)

Technical Confluence Demands Attention

Overhead, the 200-day simple moving average (SMA – white at ¥164.29), coupled with the upper boundary of the Ichimoku Cloud, the 50.0% retracement ratio and the 100% projection ratio around ¥164.92, could be enough to tempt a more solid showing from bears.

Price Direction?

Although the technical confluence around the upper region of the Ichimoku Cloud warrants attention, the trend has been strong to the upside since early 2020 for the EUR/JPY pair. The price close below the 200-day SMA supports a bearish trend reversal, though it is likely too early to call the recent correction a trend change in this market.

This places a bold question mark on the above-noted resistance confluence. Therefore, Ichimoku traders interested in shorting the upper area of the Ichimoku Cloud may wait and see if the Conversion Line (blue at ¥160.84) crosses back under the Base Line (red at ¥159.37) before committing. Slightly more aggressive sellers could consider a bearish scenario following a price close below the Base Line.

Technical Confluence Demands Attention

Overhead, the 200-day simple moving average (SMA – white at ¥164.29), coupled with the upper boundary of the Ichimoku Cloud, the 50.0% retracement ratio and the 100% projection ratio around ¥164.92, could be enough to tempt a more solid showing from bears.

Price Direction?

Although the technical confluence around the upper region of the Ichimoku Cloud warrants attention, the trend has been strong to the upside since early 2020 for the EUR/JPY pair. The price close below the 200-day SMA supports a bearish trend reversal, though it is likely too early to call the recent correction a trend change in this market.

This places a bold question mark on the above-noted resistance confluence. Therefore, Ichimoku traders interested in shorting the upper area of the Ichimoku Cloud may wait and see if the Conversion Line (blue at ¥160.84) crosses back under the Base Line (red at ¥159.37) before committing. Slightly more aggressive sellers could consider a bearish scenario following a price close below the Base Line.