EBC Markets Briefing | Bullion inches down on easing fear

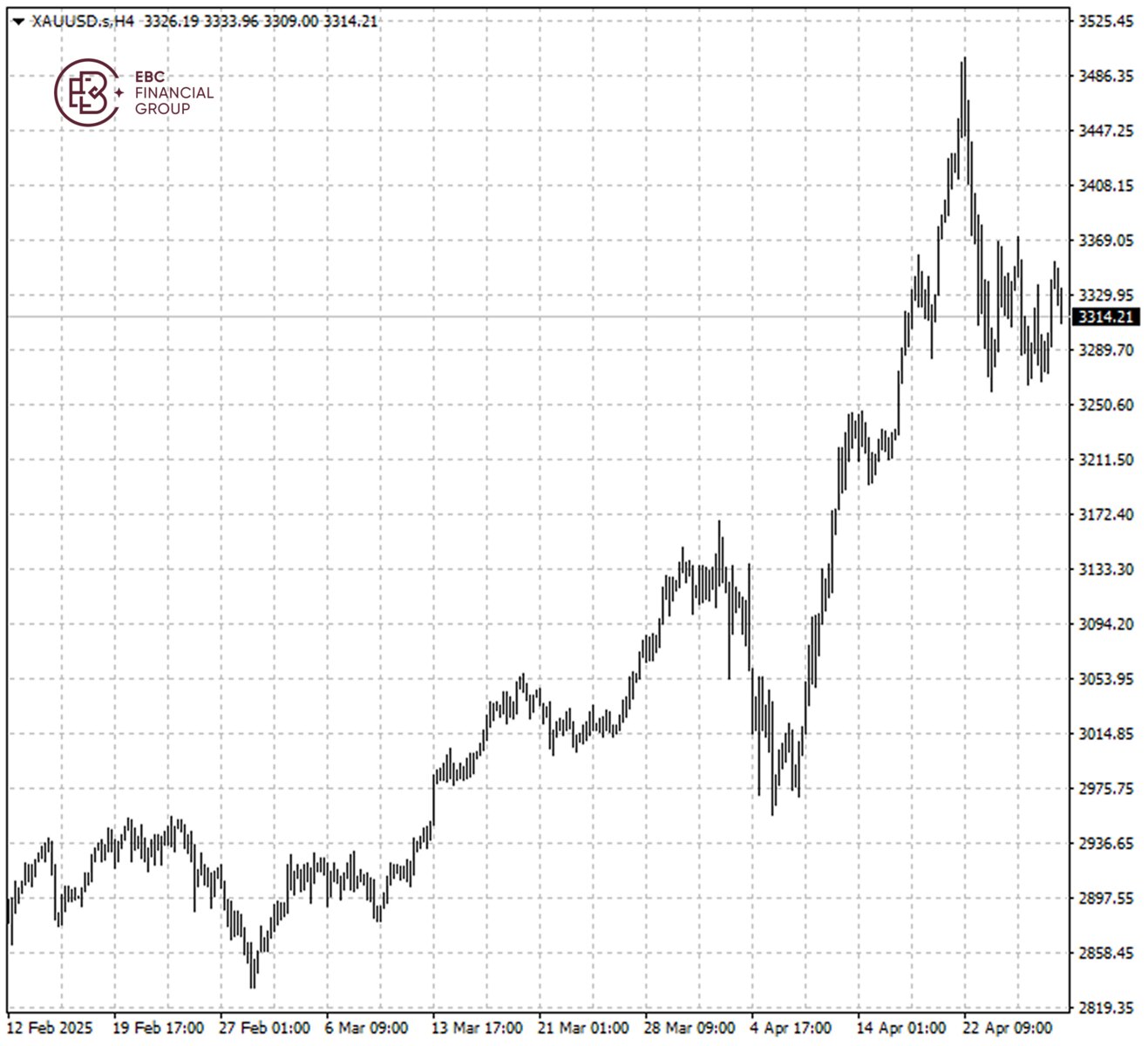

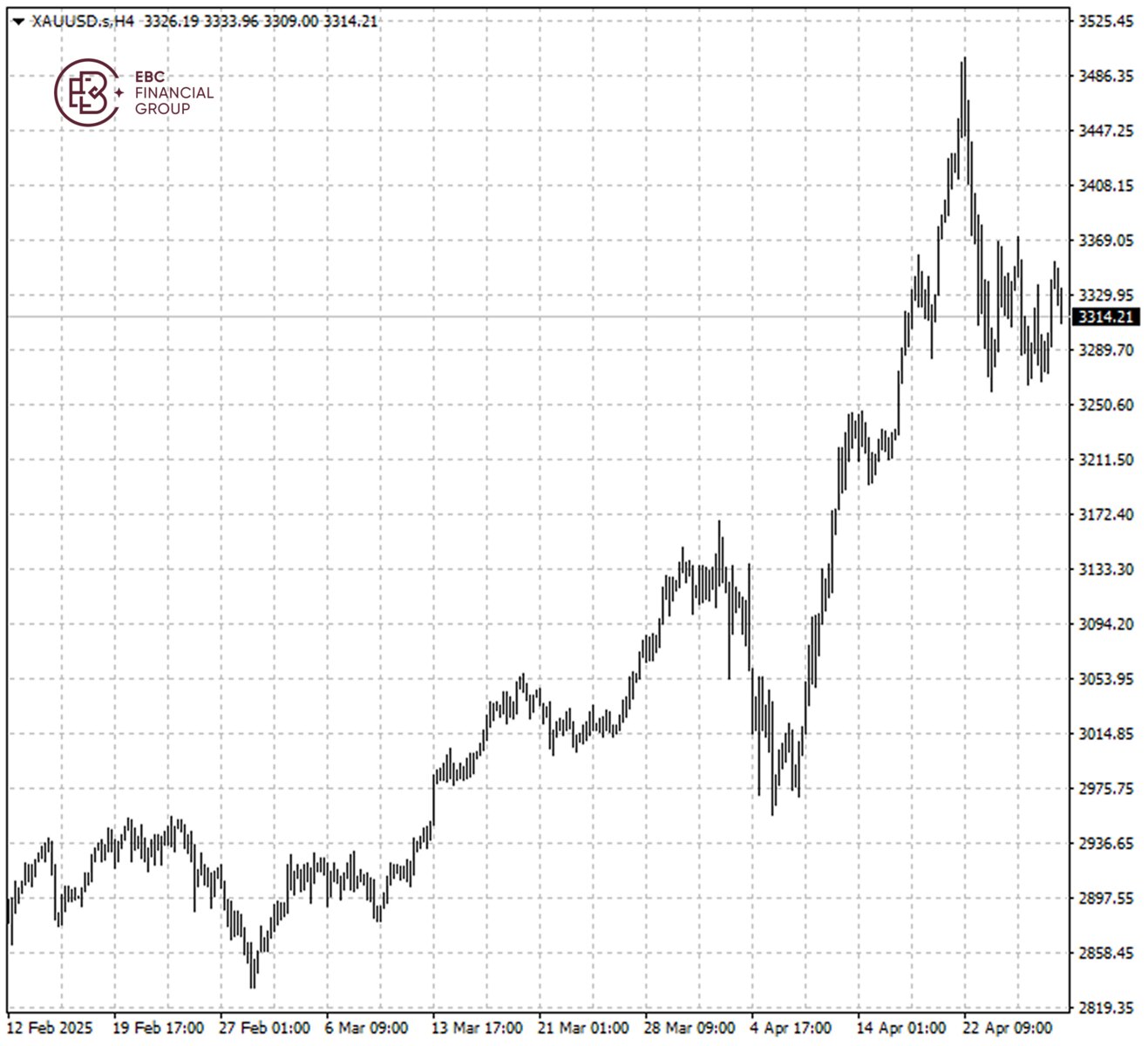

Gold fell on Tuesday as softening trade tensions between the US and its trading partners helped brighten market mood, while investors awaited economic data to assess the Fed's policy path.

Bessent said in an interview on Monday that it was up to China to de-escalate on tariffs - the latest in a slew of conflicting signals over progress on trade talks between the world's two largest economies.

Despite that, both sides in recent days seemed to have softened their respective stances, with the Trump administration signalling openness to reducing tariffs and China exempting some US imports from its 125% levies.

Treasury has seen a sell-off, with the 30-year yield hitting the highest since November 2023 earlier this month. But the traditionally inverse relationship between Treasury yields and gold are breaking down.

Analysts say the rationale is the dwindling faith in America and the "US exceptionalism" narrative. Gold's perceived independence from any monetary and fiscal policy has boosted its appeal.

According to a recent survey conducted by JPMorgan, the dollar is expected to weaken further by the end of 2025. The bank expects the yellow metal to average $3,675 by Q4, and reach $4,000 by Q2 2026.

Bessent said in an interview on Monday that it was up to China to de-escalate on tariffs - the latest in a slew of conflicting signals over progress on trade talks between the world's two largest economies.

Despite that, both sides in recent days seemed to have softened their respective stances, with the Trump administration signalling openness to reducing tariffs and China exempting some US imports from its 125% levies.

Treasury has seen a sell-off, with the 30-year yield hitting the highest since November 2023 earlier this month. But the traditionally inverse relationship between Treasury yields and gold are breaking down.

Analysts say the rationale is the dwindling faith in America and the "US exceptionalism" narrative. Gold's perceived independence from any monetary and fiscal policy has boosted its appeal.

According to a recent survey conducted by JPMorgan, the dollar is expected to weaken further by the end of 2025. The bank expects the yellow metal to average $3,675 by Q4, and reach $4,000 by Q2 2026.

Bullion failed to break above the upper end of trading range, so a deeper pullback towards $3,287 is more likely than not. Volatility may be limited until the PCE report is released.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Bullion failed to break above the upper end of trading range, so a deeper pullback towards $3,287 is more likely than not. Volatility may be limited until the PCE report is released.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Disclaimer:

Investment involves risk. The content of this report is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

Publication date:

2025-04-29 07:45:01 (GMT)

Bessent said in an interview on Monday that it was up to China to de-escalate on tariffs - the latest in a slew of conflicting signals over progress on trade talks between the world's two largest economies.

Despite that, both sides in recent days seemed to have softened their respective stances, with the Trump administration signalling openness to reducing tariffs and China exempting some US imports from its 125% levies.

Treasury has seen a sell-off, with the 30-year yield hitting the highest since November 2023 earlier this month. But the traditionally inverse relationship between Treasury yields and gold are breaking down.

Analysts say the rationale is the dwindling faith in America and the "US exceptionalism" narrative. Gold's perceived independence from any monetary and fiscal policy has boosted its appeal.

According to a recent survey conducted by JPMorgan, the dollar is expected to weaken further by the end of 2025. The bank expects the yellow metal to average $3,675 by Q4, and reach $4,000 by Q2 2026.

Bessent said in an interview on Monday that it was up to China to de-escalate on tariffs - the latest in a slew of conflicting signals over progress on trade talks between the world's two largest economies.

Despite that, both sides in recent days seemed to have softened their respective stances, with the Trump administration signalling openness to reducing tariffs and China exempting some US imports from its 125% levies.

Treasury has seen a sell-off, with the 30-year yield hitting the highest since November 2023 earlier this month. But the traditionally inverse relationship between Treasury yields and gold are breaking down.

Analysts say the rationale is the dwindling faith in America and the "US exceptionalism" narrative. Gold's perceived independence from any monetary and fiscal policy has boosted its appeal.

According to a recent survey conducted by JPMorgan, the dollar is expected to weaken further by the end of 2025. The bank expects the yellow metal to average $3,675 by Q4, and reach $4,000 by Q2 2026.

Bullion failed to break above the upper end of trading range, so a deeper pullback towards $3,287 is more likely than not. Volatility may be limited until the PCE report is released.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Bullion failed to break above the upper end of trading range, so a deeper pullback towards $3,287 is more likely than not. Volatility may be limited until the PCE report is released.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.