EBC Markets Briefing | South African rand steadies after political tumult

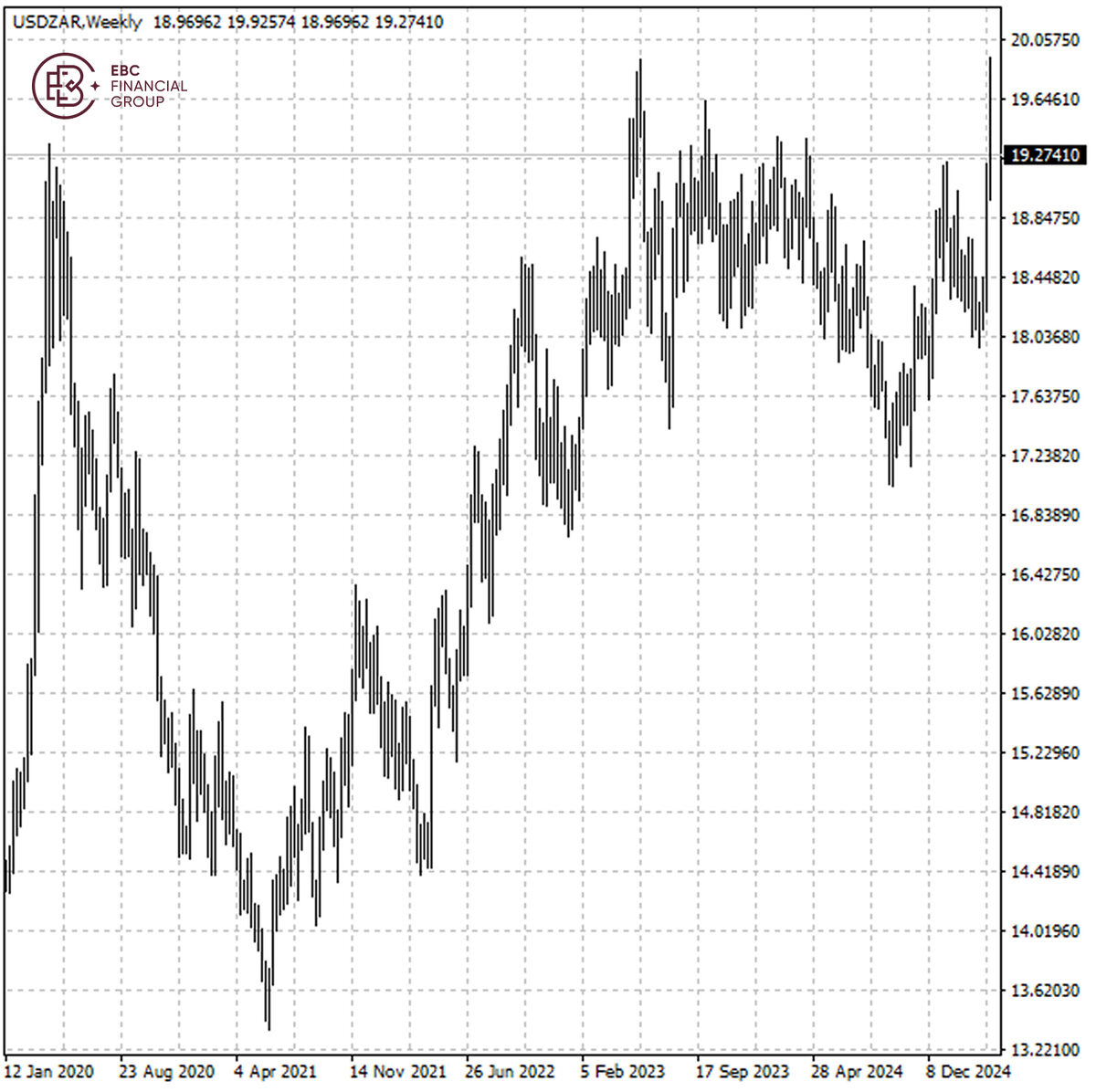

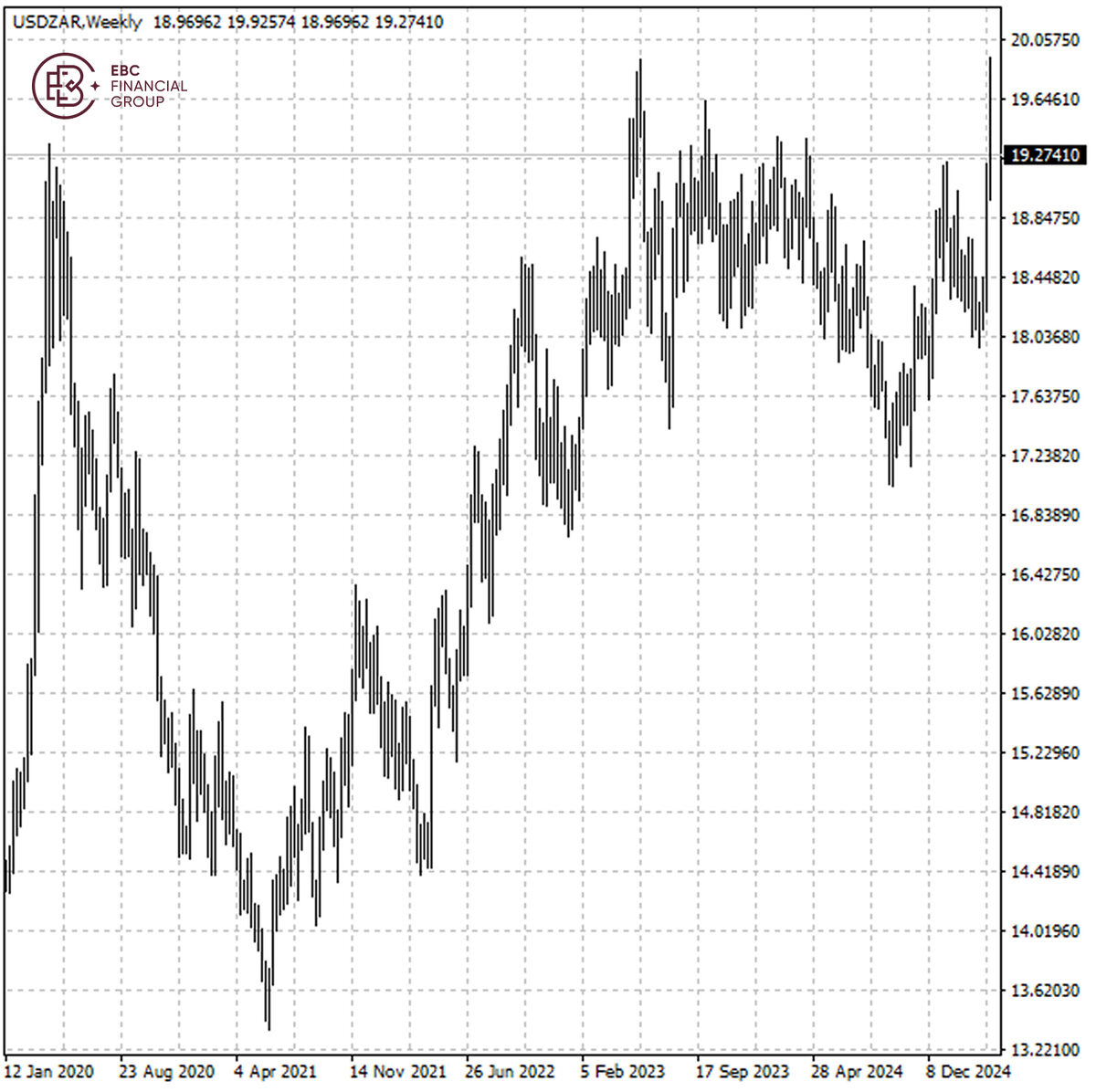

The rand remained close to an all-time low in jittery trade on Thursday, as Trump's policies and the risk that South Africa's market-friendly coalition government could split unnerved investors.

The two biggest parties in the coalition government, the ANC and DA, disagreed sharply over the budget, with the latter voting against it in parliament and going to court to try to block it.

China is the country's top export destination, so tit-for-tat trade war between the US and China, which is expected to take a toll on both economies, has been weighing on commodity currencies.

Trump made good on his threat to impose an additional 50% tariff on Beijing unless it withdrew its retaliatory levies. Soon after, China raised additional duties on American products to 84% on Wednesday.

South Africa's economy expanded at the slowest pace in Q4 as most sectors failed to contribute to growth because of logistical constraints, weak consumer spending and poor fixed investment.

A Bloomberg survey foresees the economy expanding 1.7% this year. Still, such an outcome is too tepid to dent one of the world's highest unemployment and poverty rates, and much less than the 3% official target.

The two biggest parties in the coalition government, the ANC and DA, disagreed sharply over the budget, with the latter voting against it in parliament and going to court to try to block it.

China is the country's top export destination, so tit-for-tat trade war between the US and China, which is expected to take a toll on both economies, has been weighing on commodity currencies.

Trump made good on his threat to impose an additional 50% tariff on Beijing unless it withdrew its retaliatory levies. Soon after, China raised additional duties on American products to 84% on Wednesday.

South Africa's economy expanded at the slowest pace in Q4 as most sectors failed to contribute to growth because of logistical constraints, weak consumer spending and poor fixed investment.

A Bloomberg survey foresees the economy expanding 1.7% this year. Still, such an outcome is too tepid to dent one of the world's highest unemployment and poverty rates, and much less than the 3% official target.

The rand gained some ground after weakening close to the major psychological support of 20 per dollar. The currency may have bottomed out like it did in 2023, and we see upside risks in it.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The rand gained some ground after weakening close to the major psychological support of 20 per dollar. The currency may have bottomed out like it did in 2023, and we see upside risks in it.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Disclaimer:

Investment involves risk. The content of this report is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

Publication date:

2025-04-10 12:38:45 (GMT)

The two biggest parties in the coalition government, the ANC and DA, disagreed sharply over the budget, with the latter voting against it in parliament and going to court to try to block it.

China is the country's top export destination, so tit-for-tat trade war between the US and China, which is expected to take a toll on both economies, has been weighing on commodity currencies.

Trump made good on his threat to impose an additional 50% tariff on Beijing unless it withdrew its retaliatory levies. Soon after, China raised additional duties on American products to 84% on Wednesday.

South Africa's economy expanded at the slowest pace in Q4 as most sectors failed to contribute to growth because of logistical constraints, weak consumer spending and poor fixed investment.

A Bloomberg survey foresees the economy expanding 1.7% this year. Still, such an outcome is too tepid to dent one of the world's highest unemployment and poverty rates, and much less than the 3% official target.

The two biggest parties in the coalition government, the ANC and DA, disagreed sharply over the budget, with the latter voting against it in parliament and going to court to try to block it.

China is the country's top export destination, so tit-for-tat trade war between the US and China, which is expected to take a toll on both economies, has been weighing on commodity currencies.

Trump made good on his threat to impose an additional 50% tariff on Beijing unless it withdrew its retaliatory levies. Soon after, China raised additional duties on American products to 84% on Wednesday.

South Africa's economy expanded at the slowest pace in Q4 as most sectors failed to contribute to growth because of logistical constraints, weak consumer spending and poor fixed investment.

A Bloomberg survey foresees the economy expanding 1.7% this year. Still, such an outcome is too tepid to dent one of the world's highest unemployment and poverty rates, and much less than the 3% official target.

The rand gained some ground after weakening close to the major psychological support of 20 per dollar. The currency may have bottomed out like it did in 2023, and we see upside risks in it.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The rand gained some ground after weakening close to the major psychological support of 20 per dollar. The currency may have bottomed out like it did in 2023, and we see upside risks in it.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.