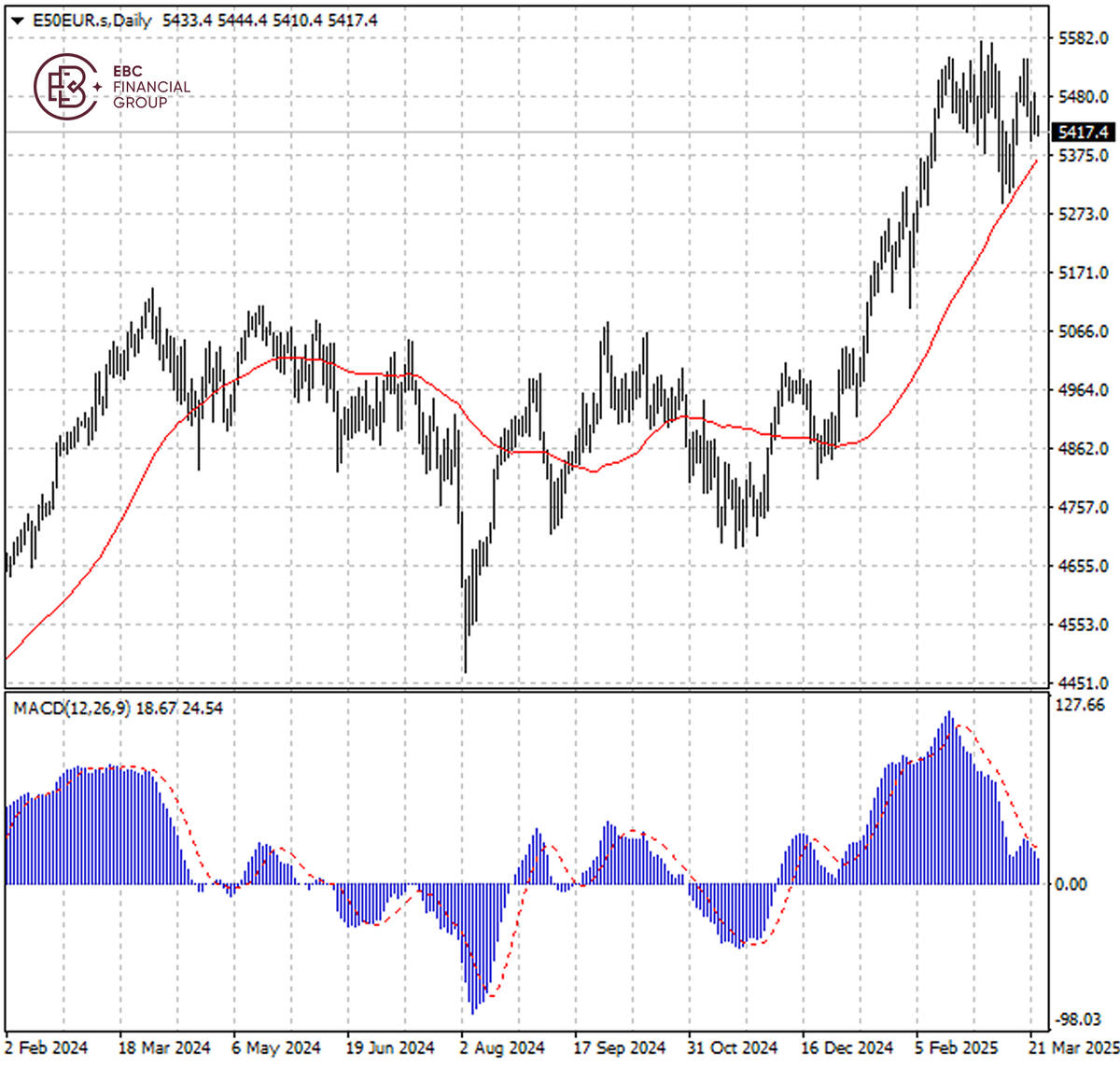

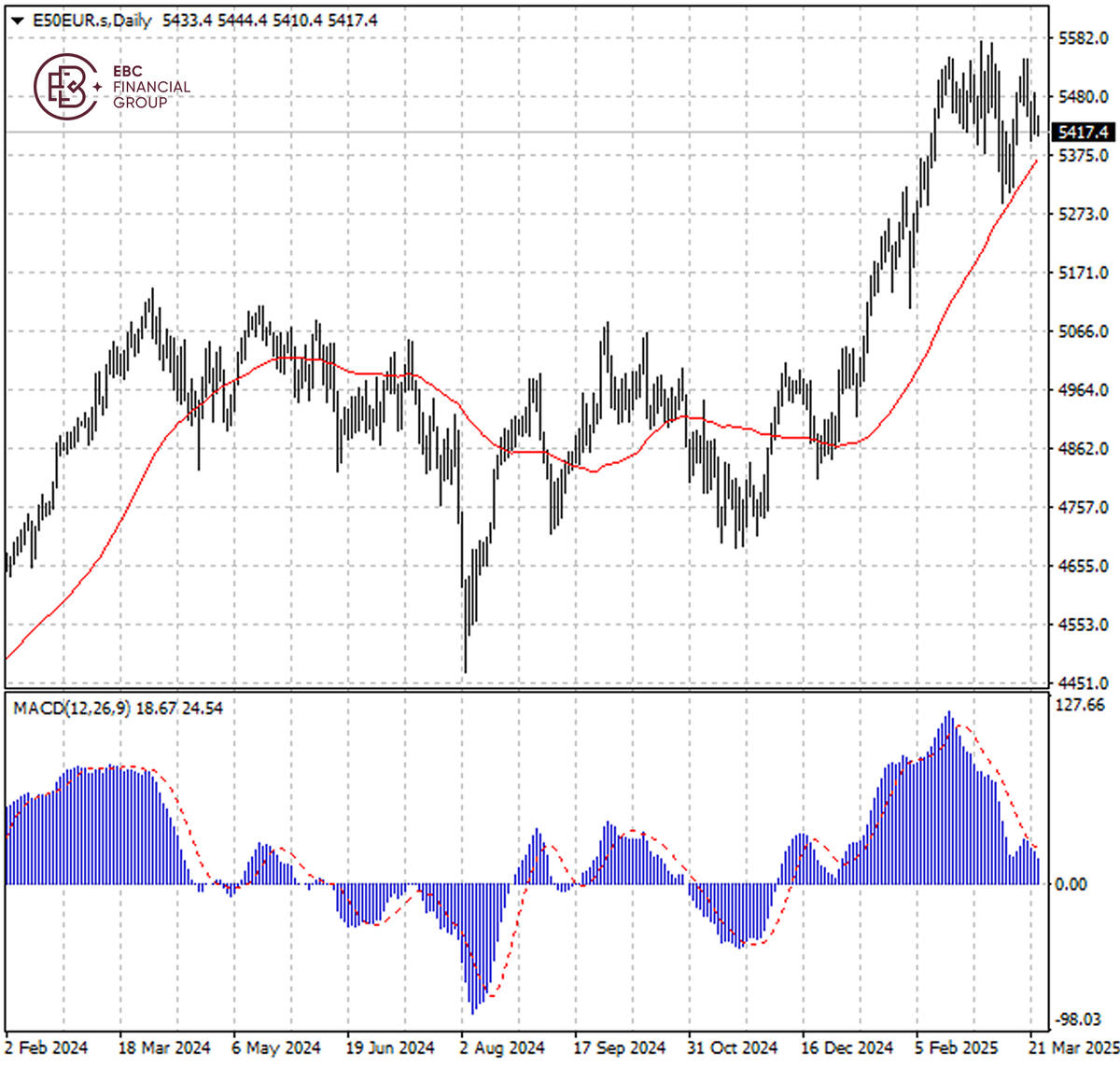

The Stoxx 50 remains supported by 50 SMA, but MACD divergence suggests the upside momentum has eased. As such the index could dip below 5,400 in the following sessions.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The Stoxx 50 remains supported by 50 SMA, but MACD divergence suggests the upside momentum has eased. As such the index could dip below 5,400 in the following sessions.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.EBC Markets Briefing | Market cautiously bullish on European stocks

The Stoxx 50 remains supported by 50 SMA, but MACD divergence suggests the upside momentum has eased. As such the index could dip below 5,400 in the following sessions.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The Stoxx 50 remains supported by 50 SMA, but MACD divergence suggests the upside momentum has eased. As such the index could dip below 5,400 in the following sessions.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.Contact:

mkt@ebc.comDisclaimer:

Investment involves risk. The content of this report is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

Publication date:

2025-03-25 08:30:16 (GMT)