EBC Markets Briefing | Oil prices rise but demand concerns linger

Oil prices rose on Thursday, recovering some of the previous day's loss, on hopes of potential Fed interest rate cuts boosting the economy, though lingering concerns over slower global demand capped gains.

Both benchmarks fell more than 1% on Wednesday after US crude inventories rose unexpectedly. The US resumed sales of offensive weapons to Saudi Arabia this week, adding to flare-up risk in the region.

Hamas said it would not take part in a new round of Gaza ceasefire talks slated for Thursday, dimming hopes for a negotiated truce. Iran has rejected western plea not to launch retaliatory attack against Israel.

Global oil markets are poised to swing from a deficit to a surplus next quarter due to slackness in China should OPEC+ proceed with plans to boost supplies, data from the EIA showed.

Even if the cartel cancels their scheduled output hikes, inventories will accumulate next year by a hefty 860,000 barrels a day amid booming supplies from the US, Guyana and Brazil, it said.

In a separate report on Monday, OPEC, which was more optimistic, trimmed its oil demand growth forecast for 2024 for the first time since it was introduced a year ago, citing softness in China.

Both benchmarks fell more than 1% on Wednesday after US crude inventories rose unexpectedly. The US resumed sales of offensive weapons to Saudi Arabia this week, adding to flare-up risk in the region.

Hamas said it would not take part in a new round of Gaza ceasefire talks slated for Thursday, dimming hopes for a negotiated truce. Iran has rejected western plea not to launch retaliatory attack against Israel.

Global oil markets are poised to swing from a deficit to a surplus next quarter due to slackness in China should OPEC+ proceed with plans to boost supplies, data from the EIA showed.

Even if the cartel cancels their scheduled output hikes, inventories will accumulate next year by a hefty 860,000 barrels a day amid booming supplies from the US, Guyana and Brazil, it said.

In a separate report on Monday, OPEC, which was more optimistic, trimmed its oil demand growth forecast for 2024 for the first time since it was introduced a year ago, citing softness in China.

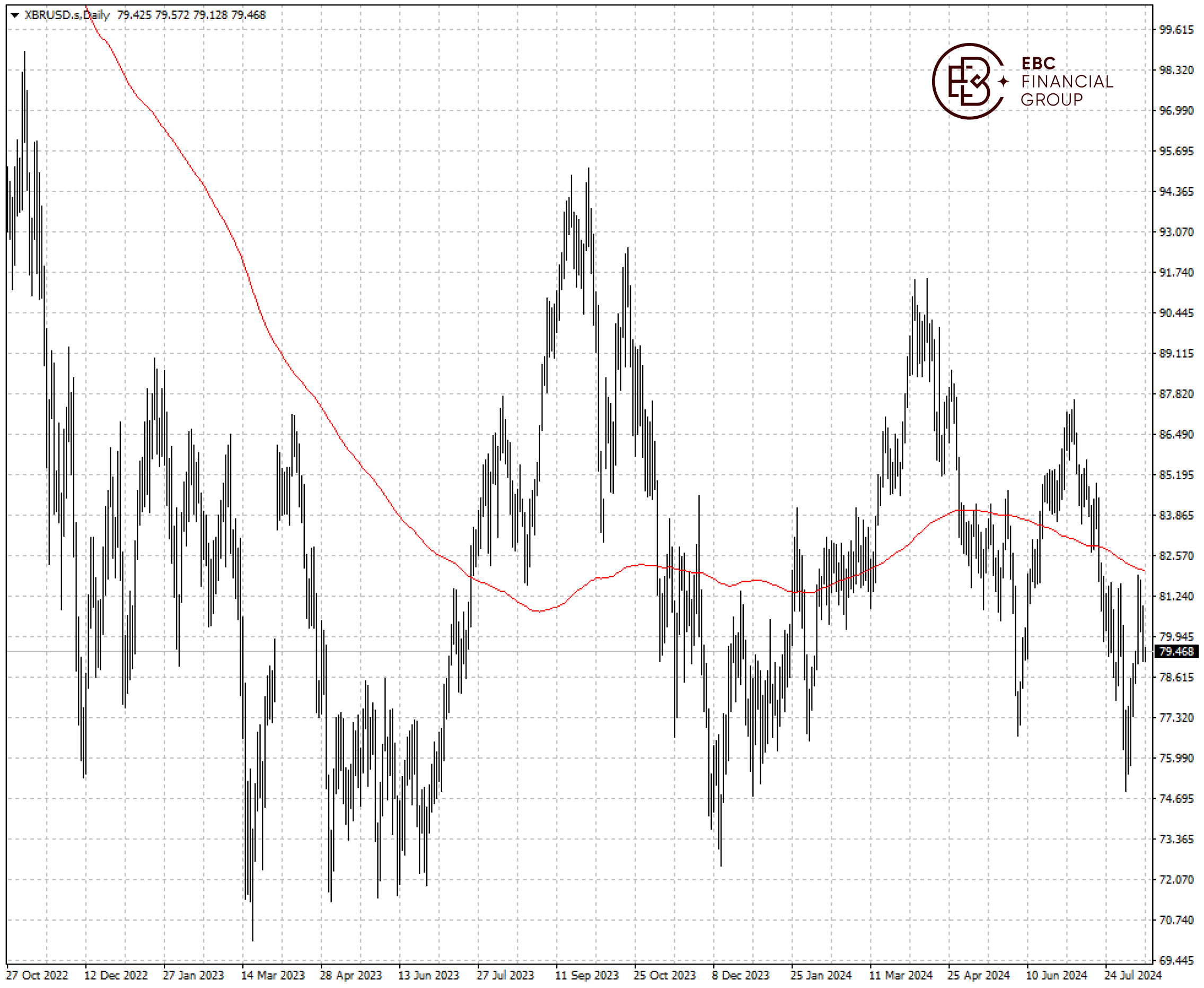

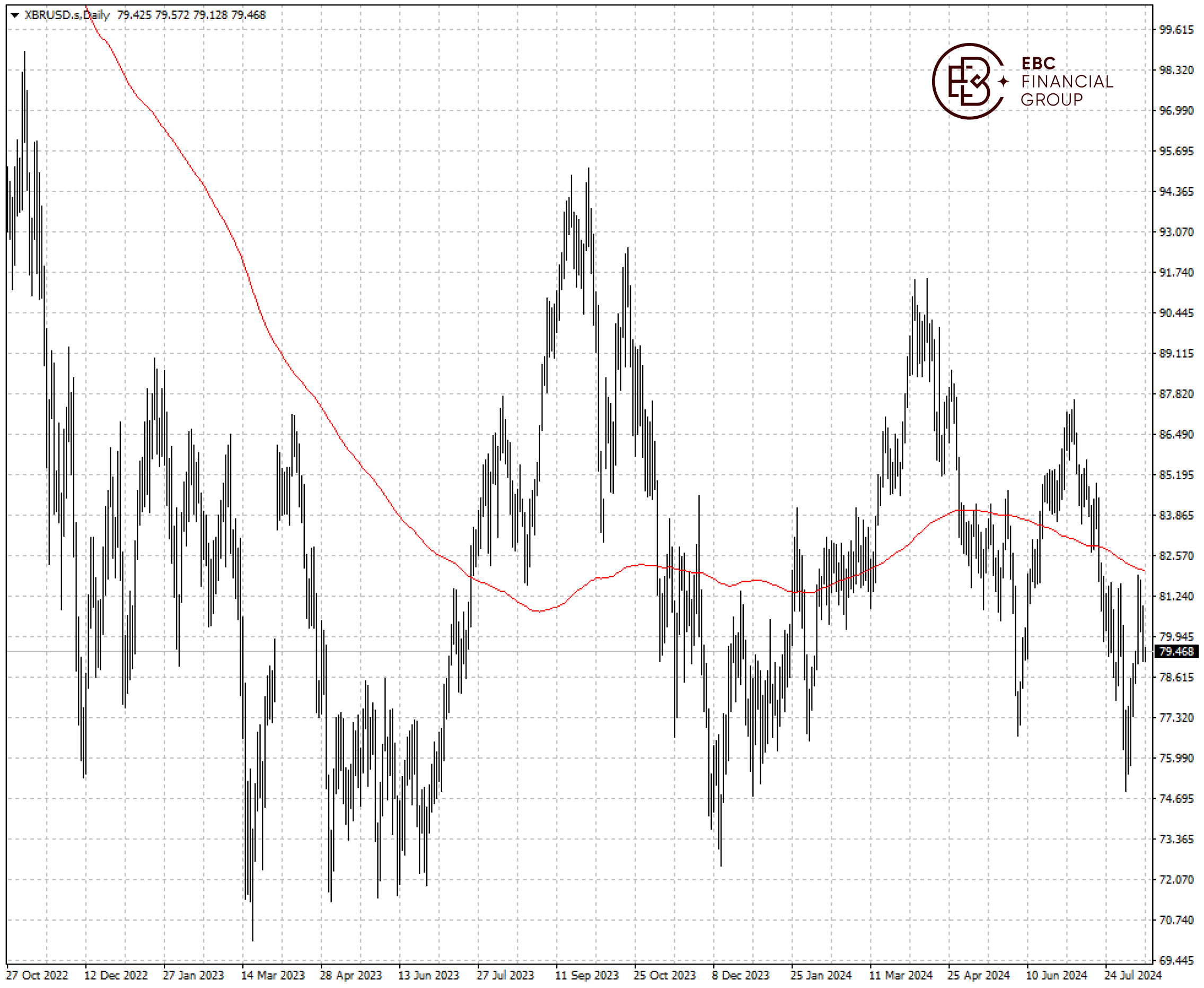

Brent crude failed to clear the resistance at 200 SMA, which abated the short-term bullish bias. Another leg lower is on the cards if the price falls below $79.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Brent crude failed to clear the resistance at 200 SMA, which abated the short-term bullish bias. Another leg lower is on the cards if the price falls below $79.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Disclaimer:

Investment involves risk. The content of this report is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product.

Publication date:

2024-08-15 11:56:15 (GMT)

Both benchmarks fell more than 1% on Wednesday after US crude inventories rose unexpectedly. The US resumed sales of offensive weapons to Saudi Arabia this week, adding to flare-up risk in the region.

Hamas said it would not take part in a new round of Gaza ceasefire talks slated for Thursday, dimming hopes for a negotiated truce. Iran has rejected western plea not to launch retaliatory attack against Israel.

Global oil markets are poised to swing from a deficit to a surplus next quarter due to slackness in China should OPEC+ proceed with plans to boost supplies, data from the EIA showed.

Even if the cartel cancels their scheduled output hikes, inventories will accumulate next year by a hefty 860,000 barrels a day amid booming supplies from the US, Guyana and Brazil, it said.

In a separate report on Monday, OPEC, which was more optimistic, trimmed its oil demand growth forecast for 2024 for the first time since it was introduced a year ago, citing softness in China.

Both benchmarks fell more than 1% on Wednesday after US crude inventories rose unexpectedly. The US resumed sales of offensive weapons to Saudi Arabia this week, adding to flare-up risk in the region.

Hamas said it would not take part in a new round of Gaza ceasefire talks slated for Thursday, dimming hopes for a negotiated truce. Iran has rejected western plea not to launch retaliatory attack against Israel.

Global oil markets are poised to swing from a deficit to a surplus next quarter due to slackness in China should OPEC+ proceed with plans to boost supplies, data from the EIA showed.

Even if the cartel cancels their scheduled output hikes, inventories will accumulate next year by a hefty 860,000 barrels a day amid booming supplies from the US, Guyana and Brazil, it said.

In a separate report on Monday, OPEC, which was more optimistic, trimmed its oil demand growth forecast for 2024 for the first time since it was introduced a year ago, citing softness in China.

Brent crude failed to clear the resistance at 200 SMA, which abated the short-term bullish bias. Another leg lower is on the cards if the price falls below $79.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Brent crude failed to clear the resistance at 200 SMA, which abated the short-term bullish bias. Another leg lower is on the cards if the price falls below $79.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.